Equalisation Levy

The Google Tax/Equalisation levy

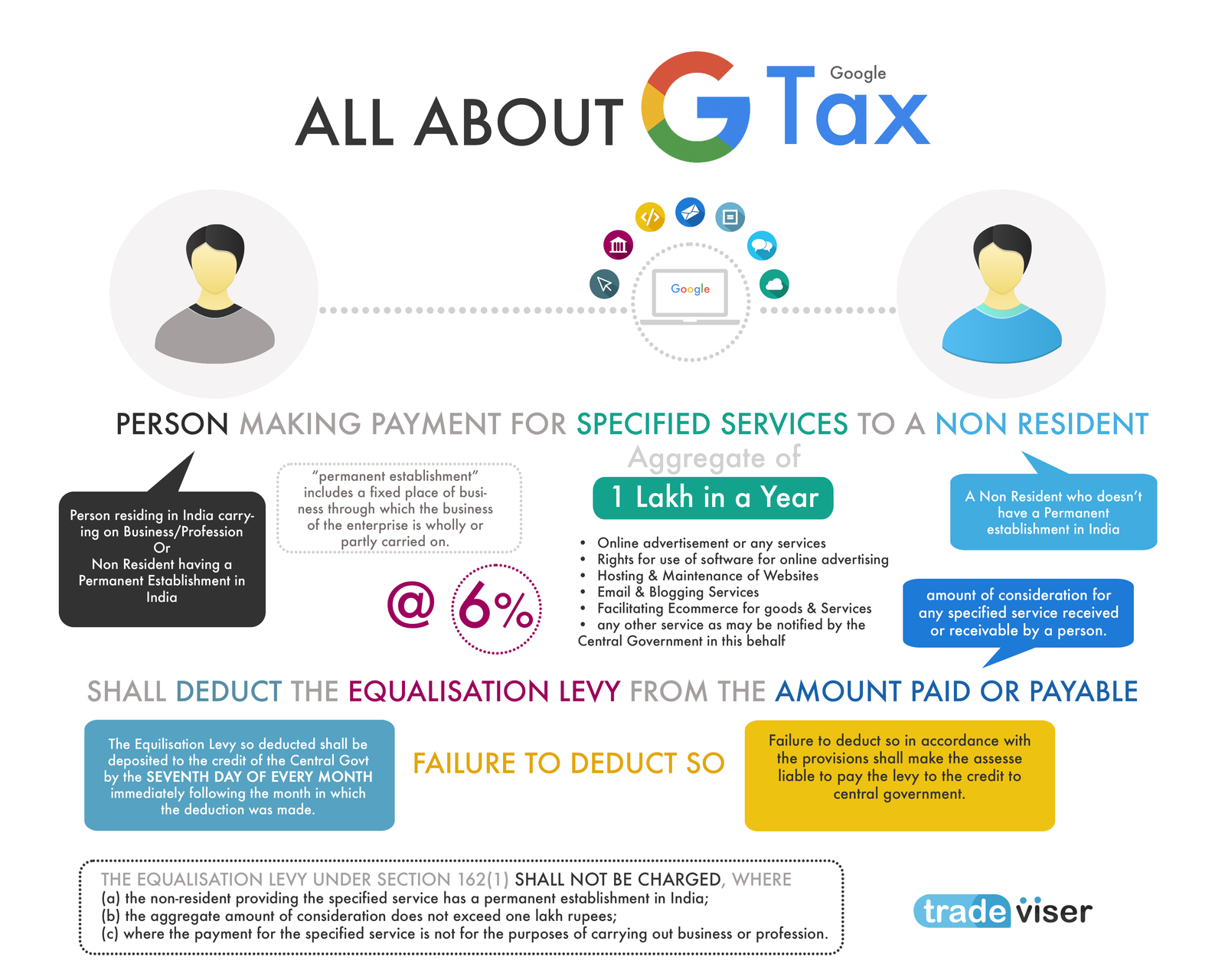

Person residing in India carrying on Business/Profession Or Non Resident having a Permanent Establishment in India while making payment towards specified services to a Non Resident who doesn’t have a Permanent establishment in India exceeding in aggregate of INR 1 Lakh in a Year shall withhold a tax at 6% of the gross amount paid or payable as equalisation levy.

The equalisation levy under section 162(1) shall not be charged, where

- the non-resident providing the specified service has a permanent establishment in India; or

- the aggregate amount of consideration for specified service received or receivable in a previous year does not exceed one lakh rupees; or

- where the payment for the specified service is not for the purposes of carrying out business or profession.

Collection & Deposit of the levy

The Equilisation Levy so deducted shall be deposited to the credit of the central government by the seventh day of every month immediately following the month in which the deduction was made.

Failure to deduct so in accordance with the provisions shall make the assessee liable to pay the levy to the credit to the central government.

Corporate Law Practitioner, Working On Rewiring The Compliance Industry, Founder & CEO of Tradeviser.in, I blend my background in Chartered Accountancy with a passion for brand strategy and design. From launching Odishas first English lifestyle magazine to building a platform that has empowered 2,000+ businesses, I’m driven to simplify compliance and help startups grow with confidence.