Composite Supply vs Mixed Supply

Composite Supply

“Composite Supply” means a supply made by any taxable person to a recipient comprising two or more supplies of goods or services, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply.

Interpreting the above definition in law Composite Supply can be explained as when one or more goods and services are supplied as a part of a single package and are bundled such way in the ordinary course of business. Composite supply is taxed at the rates applicable to the principal supply.

Principal Supply means the supply of goods and services which constitutes the predominant element of a composite supply and to which any other supply forming part of that composite supply is ancillary and does not constitute, for the recipient an aim in itself, but a means for better enjoyment of the principal supply.

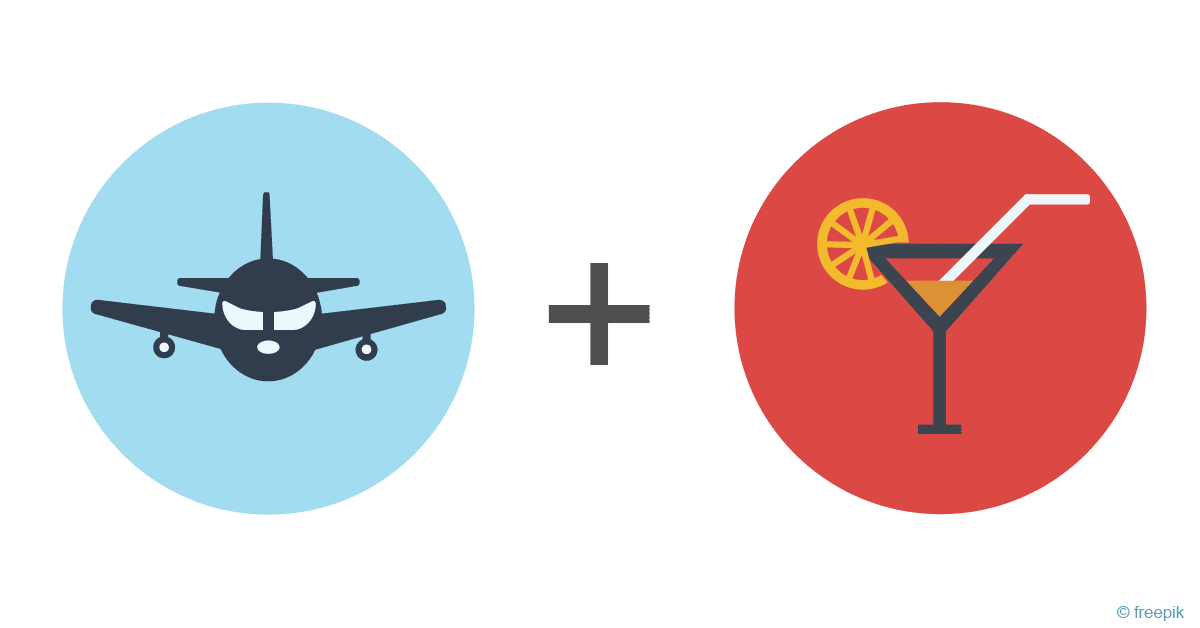

For example

When we buy Air tickets the food served during the flight forms a part of the journey, it can be constituted as a Composite supply.

Mixed Supply

“Mixed Supply” means two or more individual supplies of goods or services, or any combination thereof, made in conjunction with each other by a taxable person for a single piece where such supply does not constitute a composite supply.

Mixed Supply on the other hand is packing two or more individual goods or services which very well have different identities and can be supplied separately and are not dependent on each other. Such supplies are taxed at the rate of supply which attracts the highest rate of tax. As per our understanding to determine if a supply is a composite supply the following points are to be taken into consideration:

- Bundled in ordinary course of the business

- Are dependent on each other

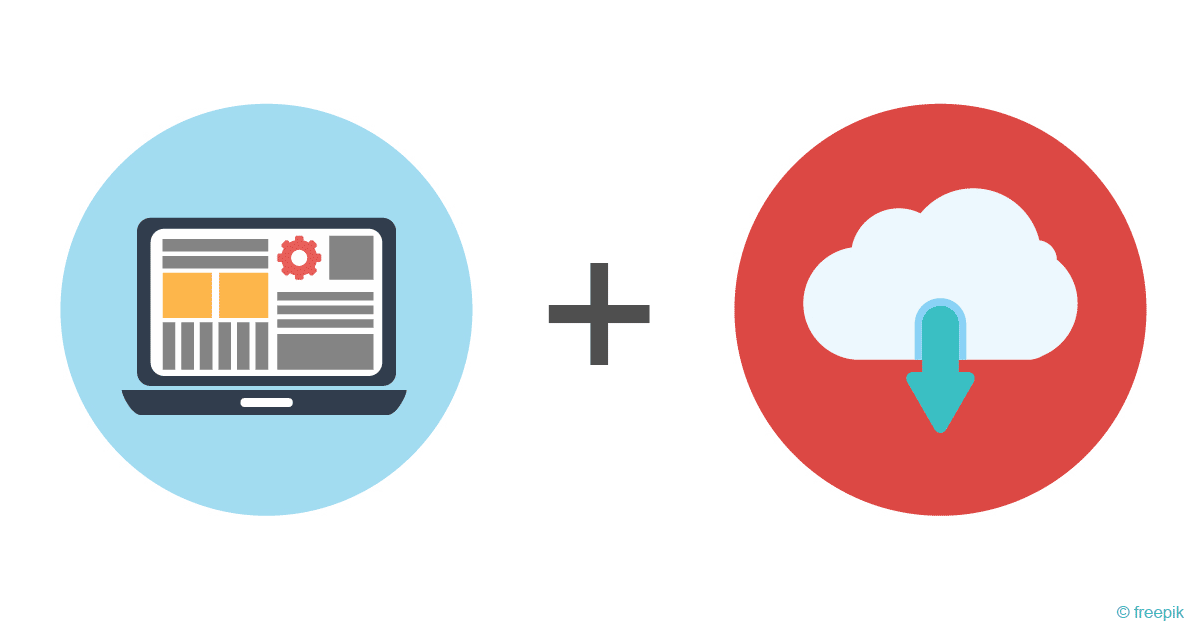

For example:

When we buy a Laptop as a package that gives us an included cloud service it can be constituted as a mixed supply.

Corporate Law Practitioner, Working On Rewiring The Compliance Industry, Founder & CEO of Tradeviser.in, I blend my background in Chartered Accountancy with a passion for brand strategy and design. From launching Odishas first English lifestyle magazine to building a platform that has empowered 2,000+ businesses, I’m driven to simplify compliance and help startups grow with confidence.