Cancellation of GST Registration

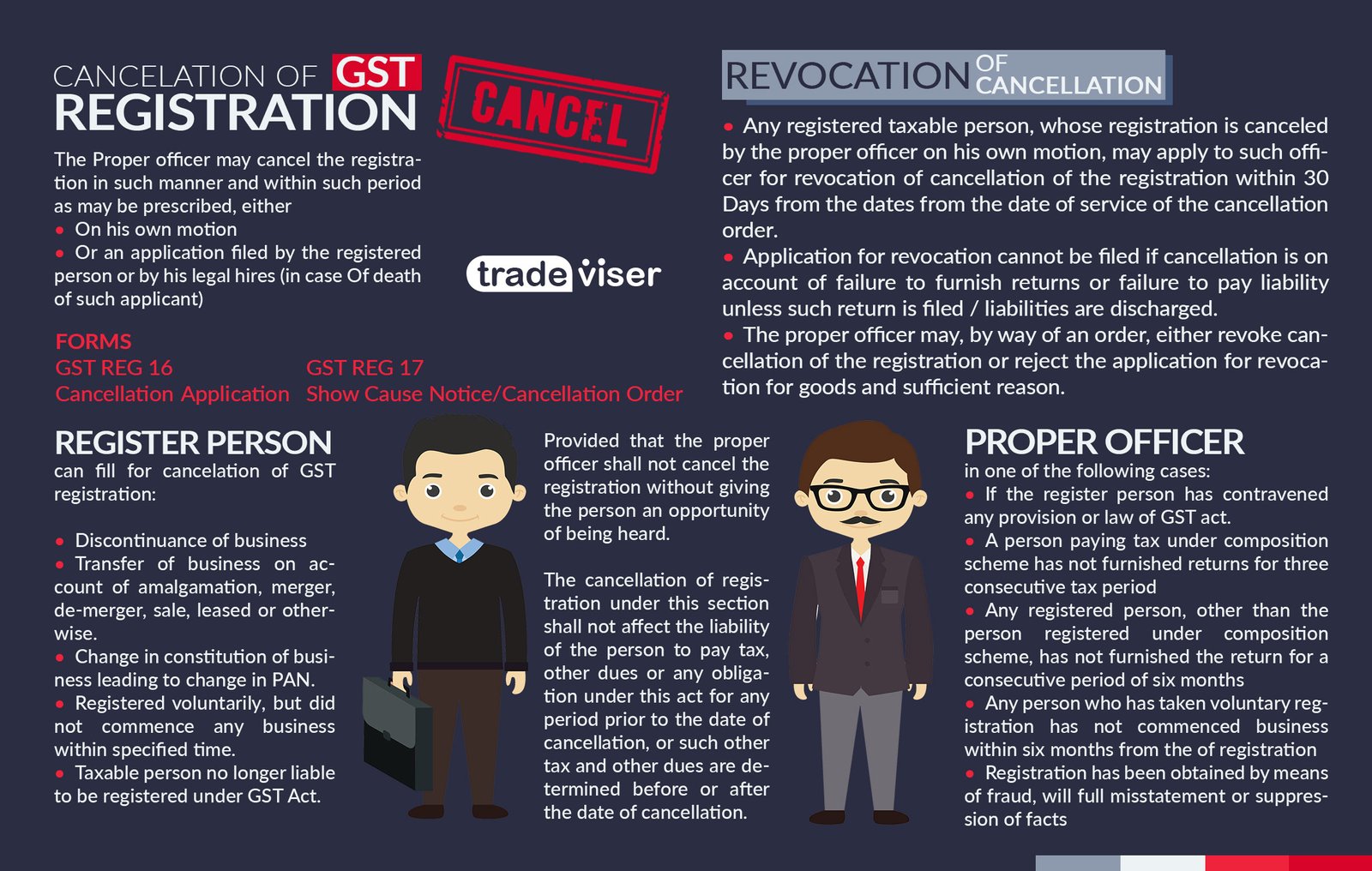

Cancelation of GST Registration

The Proper officer may cancel the registration in such manner and within such period as may be prescribed, either

- On his own motion

- Or an application filed by the registered person or by his legal hires (in case Of death of such applicant)

Under the following circumstances, a registered person can fill for the cancelation of GST registration.

- Discontinuance of business

- Transfer of business on account of amalgamation, merger, de-merger, sale, leased or otherwise.

- Change in constitution of business leading to change in PAN.

- Registered voluntarily, but did not commence any business within a specified time.

- Taxable person no longer liable to be registered under GST Act.

GST registration of a person or business can be canceled by the proper officer in one of the following cases:

- If the registered person has contravened any provision or law of GST act.

- A person paying tax under composition scheme has not furnished returns for three consecutive tax period

- Any registered person, other than the person registered under composition scheme, has not furnished the return for a consecutive period of six months

- Any person who has taken voluntary registration has not commenced business within six months from the of registration

- Registration has been obtained by means of fraud, will full misstatement or suppression of facts

Provided that the proper officer shall not cancel the registration without giving the person an opportunity of being heard.

The cancellation of registration under this section shall not affect the liability of the person to pay tax, other dues or any obligation under this act for any period prior to the date of cancellation, or such other tax and other dues are determined before or after the date of cancellation.

The amount payable of pending tax after the cancellation of registration:

- The person shall pay an amount equivalent to the credit of input tax in respect of input held in stock and input contained in semi-finished or finished goods held in stock on the immediately preceding the date of such cancellation or output tax payable on such goods, whichever is higher of the two.

- Provided that in case of capital goods or plant and machinery, the taxable person will have to pay either the input back which was taken on these capital goods, reduced by a certain percentage or tax applicable on the transaction value of goods, which is higher of the two.

Revocation Of Cancellation Of Registration

- Any registered taxable person, whose registration is canceled by the proper officer on his own motion, may apply to such officer for revocation of cancellation of the registration within 30 Days from the dates from the date of service of the cancellation order.

- Application for revocation cannot be filed if cancellation is on account of failure to furnish returns or failure to pay liability unless such return is filed / liabilities are discharged.

- The proper officer may, by way of an order, either revoke cancellation of the registration or reject the application for revocation for goods and sufficient reason.

Tradeviser, an idea shaped into reality with the motive of helping new businesses and startups with professional guidance end-to-end business services. Ever since its inception since 2016, Team Tradeviser has worked diligently with over 200 startups and been part of their of their sedulous journey to make it to the big picture.