Registrations Required to Start A Non-Profit Organization

If you have a long-term goal of working for a cause and dedicating yourself towards making a change in the world out there, then registering a Non-Governmental Organization would be one of the first steps in the list of things want to do. Non-Governmental Organization or Non-Profit Organization is an organization where a group of like-minded individuals joins hands for fulfilling a social cause. Also, a lot of Companies get into NGO Domain just to evade taxes and weave their sheet of financial frauds. Such form of organizations has a long history of scams and financial frauds, which is the reason why NGOs currently have huge donations, foreign contributions, etc. But again there are also people who genuinely wish to contribute to the society and thrive to make it a better place. So in order to begin the process here are few important things you need to know about before venturing into this domain

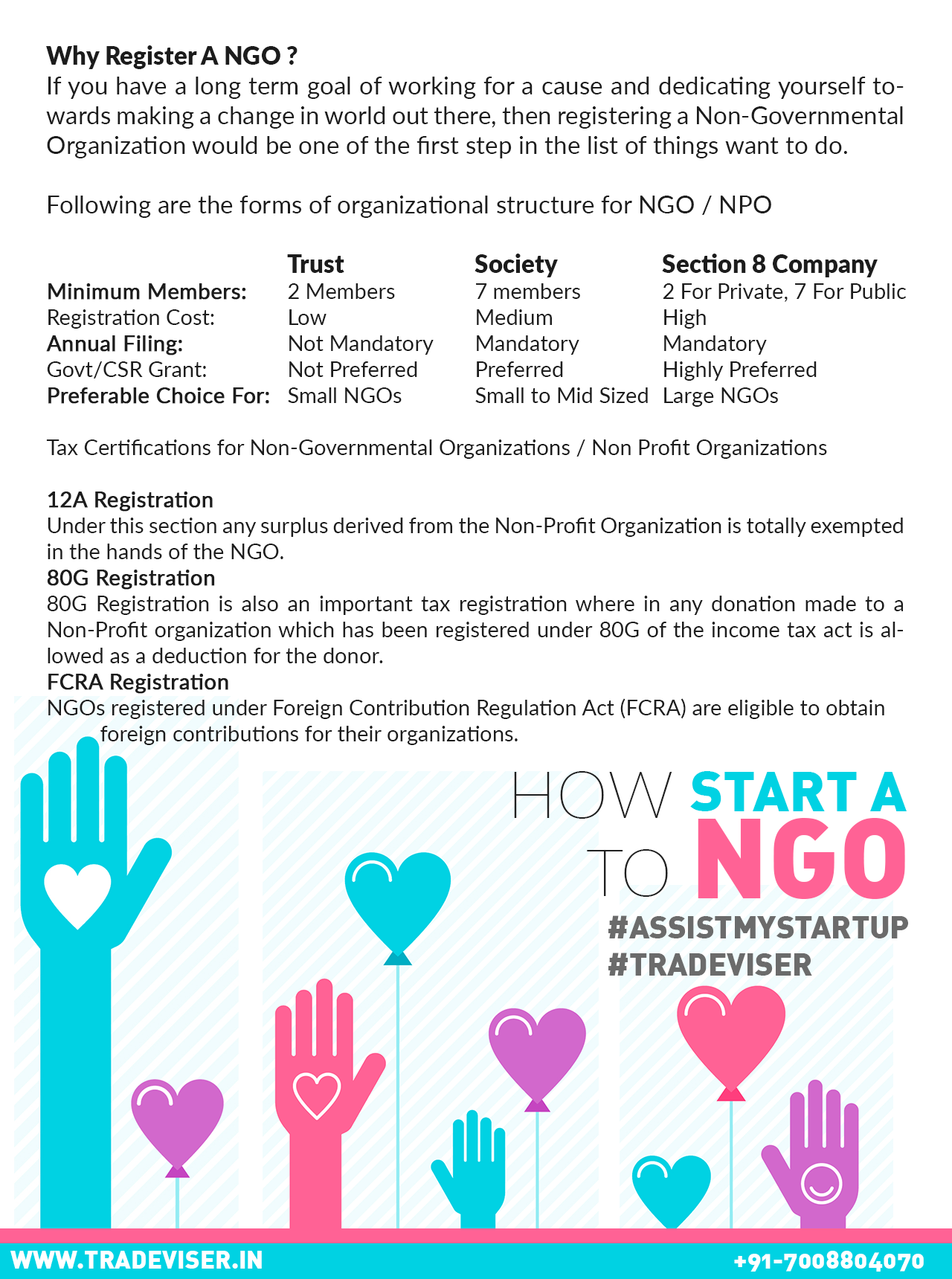

Following are the forms of organizational structure for NGO / NPO

1. Trust Registration:

Trust is the simplest form of organizational structure there is for NGOs. Trusts are registered under Indian Trust Act 1882. Trusts are more suitable for NGOs having confined jurisdiction and having objects which don’t involve acting outside such jurisdiction.

Minimum Members: Two Members

Registration Cost: Low

Annual Filing: Not Mandatory

Govt Grant: Not Preferable

2. Society Registration:

Society is the most common form of structure people choose for NGOs/NPOs. Societies are registered under Societies Registration Act 1860 modified by states according to their needs. This means Societies are more suitable for NGOs running their operations within a state. Multi-State NGOs generally take the Section 8 route.

Minimum Members: Seven Members

Registration Cost: Medium

Annual Filing: Mandatory

Govt Grant: Not Preferable

Section 8 Company is a Non-Profit Oriented Company registered under Companies Act 2013. This form of business is more suited for NGOs looking for a national presence or has major expansion plans. Section 8 company erstwhile Section 25 Company of Companies Act 1956. Minimum Members: Two for Private, Seven for Public

Registration Cost: High

Annual Filing: Mandatory

Govt Grant: Most Preferable

Tax Certifications for Non-Governmental Organizations / Non-Profit Organizations

Income tax benefits act as a boosting mechanism for NGOs since getting a Tax Exemption can give the NGO benefits such as tax exemptions for all the surplus and exemption for donors.

12A Registration

Under this section, any surplus derived from the Non-Profit Organization is totally exempted in the hands of the NGO. Any type of organization such as Trust, Society or a Section 8 company is eligible to get the 12A certification.

80G Registration

80G Registration is also an important tax registration wherein any donation made to a Non-Profit organization which has been registered under 80G of the income tax act is allowed as a deduction for the donor. This section attracts more donors as they get a tax benefit for their donations.

FCRA Registration

NGOs registered under Foreign Contribution Regulation Act (FCRA) are eligible to obtain foreign contributions for their organizations. This registration is mandatory for any charitable organization which intends to raise donations from other countries. FCRA registration is also recommended because it opens opportunities for collecting donation from foreign countries.