Annual ROC Filing For A One Person Company

Every Company registered under the Companies Act is required to file a set of annual compliances with the Registrar Of Companies. One Person Company is mandatorily required to comply with such requirements as a part of its annual compliances and must do the annual OPC ROC Filing.

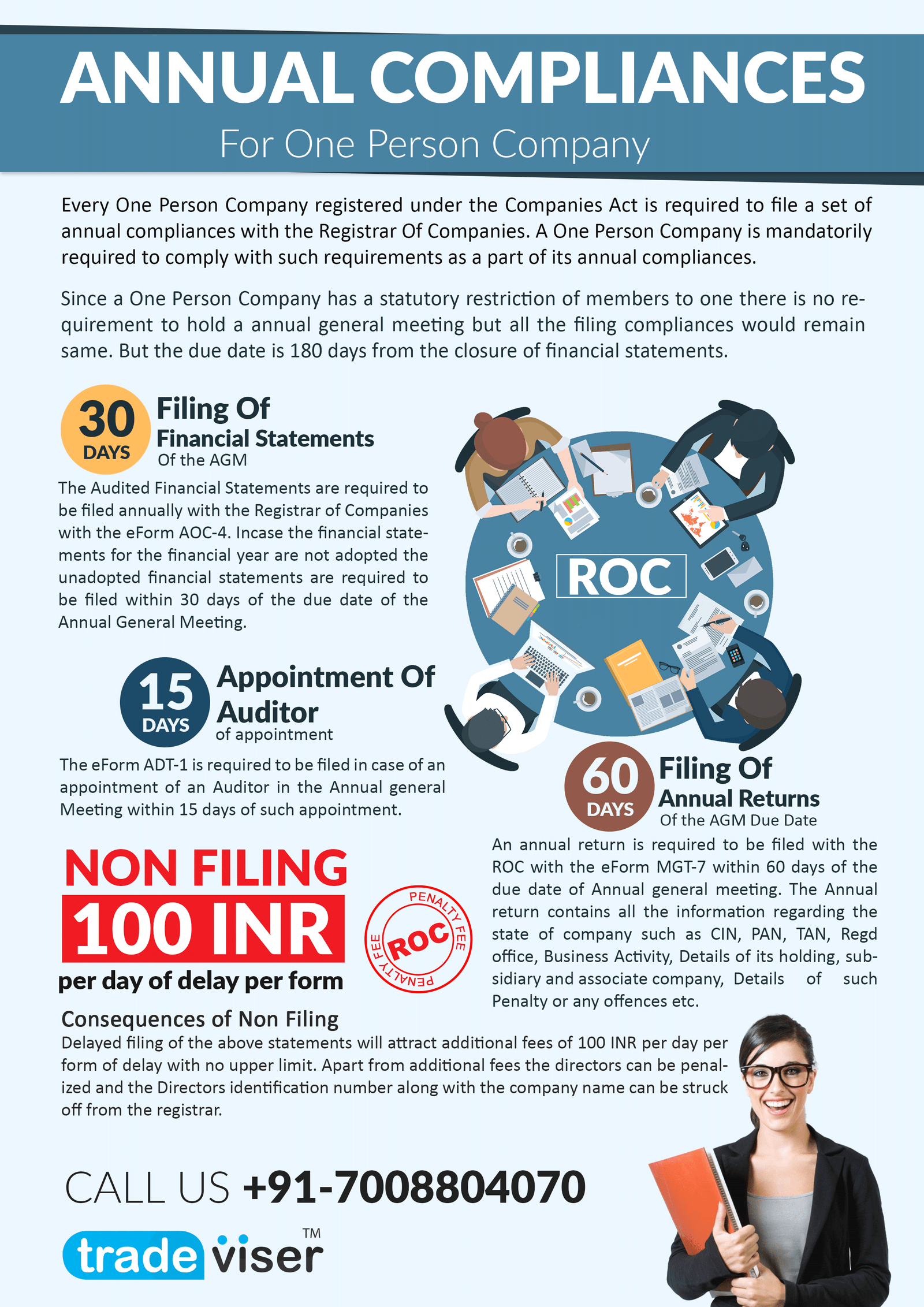

Since a One Person Company has a statutory restriction of members to one there is no requirement to hold an annual general meeting but all the filing compliances would remain the same. But the due date is 180 days from the closure of financial statements. Following are the documents which are to be filed with the Registrar Of Companies (ROC):

Filing Of Financial Statements

The Audited Financial Statements are required to be filed annually with the Registrar of Companies with the e-Form AOC-4. In case the financial statements for the financial year are not adopted the unadopted financial statements are required to be filed within 30 days of the due date of the Annual General Meeting.

Fining Of Annual Returns

An annual return is required to be filed with the ROC with the e-Form MGT-7 within 60 days of the Annual general meeting. The Annual return contains all the information regarding the state of the company such as:

- Company Details( CIN, PAN, TAN, Regd office, Business Activity, Details of its holding, subsidiary and associate company)

- Details of Shareholder

- Details of promoters, directors or KMP

- Details of such Penalty or any offenses

- Any other information & disclosures

Appointment of Auditors

The e-Form ADT-1 is required to be filed in case of an appointment of an Auditor within 15 days of such an appointment.

Consequences of Non Filing

Delayed in the OPC ROC Filing of the above statements will attract additional fees of 100 INR per day per Form of delay with no upper limit. Apart from the additional fees, the directors can be penalized and the Director’s identification number along with the company name can be struck off from the registrar.

Click here to file your ROC Compliances.