DIR 3 KYC Update For Directors Holding DIN

Update: Due date for the year 2020 onwards.

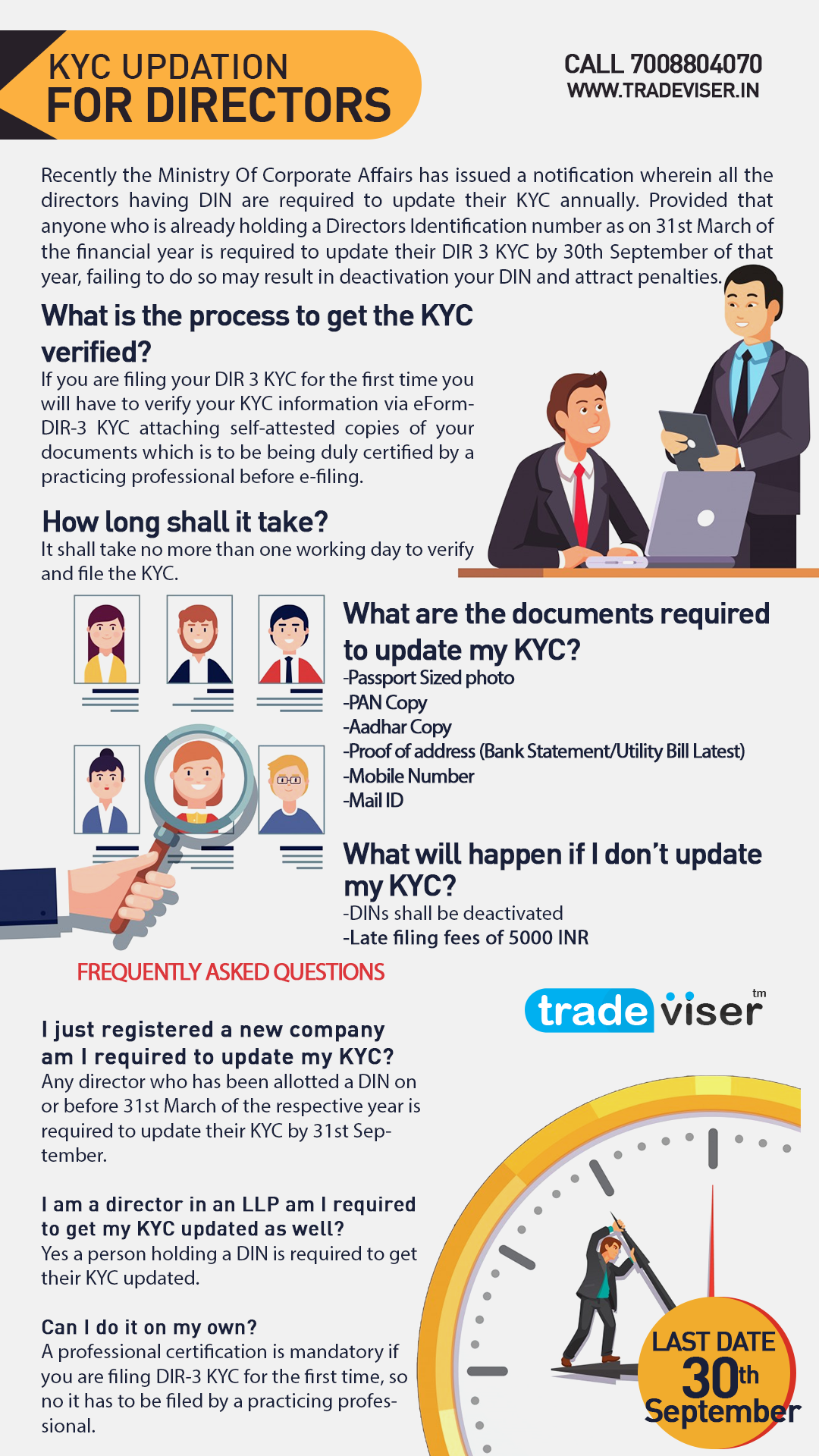

Recently the Ministry Of Corporate Affairs has issued a notification wherein all the directors having DIN are required to update their KYC annually. Provided that anyone who is already holding a Directors Identification number as on 31st March of the financial year is required to update their DIR 3 KYC by 30th September of that year, failing to do so may result in deactivation your DIN and attract penalties.

What is the process to get the KYC verified?

If you are filing your DIR 3 KYC for the first time you will have to verify your KYC information via DIR-3 KYC eForm attaching self-attested copies of your documents which is to be being duly certified by a practicing professional before e-filing.

What are the documents required to update my KYC?

Following are the documents and information required to update your KYC for the first time :

- Passport Sized photo

- PAN Copy

- Aadhar Copy

- Proof of address (Bank Statement/Utility Bill Latest)

- Mobile Number

- Mail ID

How long shall it take?

It shall take no more than two working days to verify and file the KYC.

What will happen if I don’t update my KYC?

Following will the consequences in case the director holding DIN don’t update their KYC by 30th September:

- DINs shall be deactivated and shall remain so till the KYC is updated

- Late filing fees of 5000 INR has to be born to activate and file the KYC particulars.

Our team of professionals can get your KYC updated at best price(Starting at 599 INR), click here to book your slot.

Other Frequently Asked Questions

I just registered a new company is I required to update my KYC?

Any director who has been allotted a Directors Identification Number on or before 31st March of the respective year is required to update their KYC by 31st September. This means if you were allotted your DIN after 31st March 2020 you are required to update your KYC by 30th September 2021.

I am a director in an LLP am I required to get my KYC updated as well?

Yes, a person holding a DIN (Directors Identification Number) irrespective of holding directorship in a Limited Liability Partnership or a Private Limited Company is required to get their KYC updated.

I am the sole director of my OPC, does this apply to me?

Yes even if you are a director of an OPC you are required to get your KYC updated.

I was disqualified as a director, am I required to update my KYC?

As per our understanding of the notification anyone holding a DIN irrespective of them being disqualified is required to get your KYC updated.

Can I do it on my own?

Professional certification is mandatory if you are filing the DIR 3 KYC for the first time, so no it has to be filed by a practicing professional.

Corporate Law Practitioner, Working On Rewiring The Compliance Industry, Founder & CEO of Tradeviser.in, I blend my background in Chartered Accountancy with a passion for brand strategy and design. From launching Odishas first English lifestyle magazine to building a platform that has empowered 2,000+ businesses, I’m driven to simplify compliance and help startups grow with confidence.