10 Ways To Save Income Tax In 2020

Updated for FY 2019-20

The Income Tax Act 1961 has many provisions under which an assessed can save or plan their taxes accordingly. This blog post aims to give you an overview of such common provisions which can help reduce your tax liability at the end of your financial year.

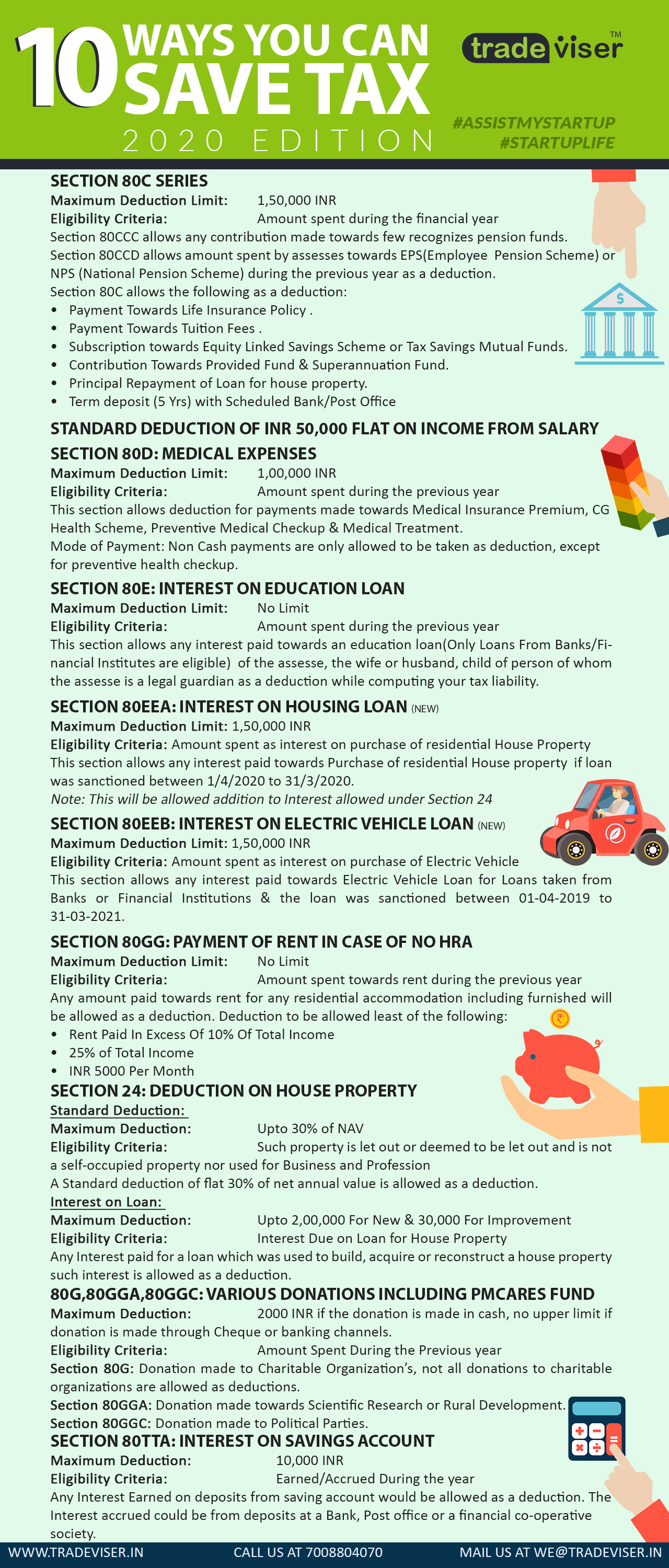

1. Section 80C Series (80C, 80CCC, 80CCD)

Maximum Deduction Limit: 1,50,000 INR

Eligibility Criteria: Amount spent during the financial year

Section 80C is a wide section and covers various types of expenses and investments which can be claimed as a deduction for saving taxes.

- Payment Towards Life Insurance Policy of Assesse, the wife or husband or child of such assesse.

- Payment Towards Tuition Fees (Excluding any kind of donation) of Assesse, the wife or husband or child of such assesse.

- Subscription towards Equity Linked Savings Scheme or Tax Savings Mutual Funds by the assesse.

- Contribution Towards Provided Fund.

- Contribution Towards Superannuation Fund.

- Repayment of Loan which was taken for the purposes of construction or purchase of a residential house property.

Section 80CCC allows any contribution made towards few recognizes pension funds, since these schemes give lower return than a basic bank saving scheme its not recommended, but anyways if you have been paying under such scheme you can claim such amount as a deduction under section 80CCC.

Section 80CCD allows amount spent by assesses towards EPS(Employee Pension Scheme) or NPS (National Pension Scheme) during the previous year as a deduction.

2. Section 80D: Medical Expenses

Maximum Deduction Limit: 1,00,000 INR

Eligibility Criteria: Amount spent during the previous year

This section allows deduction for payments made towards Medical Insurance Premium, CG Health Scheme, Preventive Health Checkup & Medical Treatment.

Medical Insurance Premium: any payment towards medical insurance premium of the assesse, the wife or husband, child or parents of such assesse.

Central Govt Heal Scheme: Deduction can also be taken for Contribution to CG Healthcare scheme of the assesse, the wife or husband and child.

Preventive Health Checkup: This also covers expenses for preventive medical checkup up to 5,000 INR.

Mode of Payment: Non Cash payments are only allowed to be taken as deduction, except for preventive health checkup.

3. Section 80E: Interest On Education Loan

Maximum Deduction Limit: No Limit

Eligibility Criteria: Amount spent during the previous year

This section allows any interest paid towards an education loan(Only Loans From Banks/Financial Institutes are eligible) of the assesse, the wife or husband, child of person of whom the assesse is a legal guardian as a deduction while computing your tax liability.

4. Section 80EEA: Interest on Housing Loan (New Added by Finance Act 2019)

Maximum Deduction Limit: 1,50,000 INR

Eligibility Criteria: Amount spent as interest on purchase of residential House Property

This section allows any interest paid towards Purchase of residential House property if loan was sanctioned between 1/4/2020 to 31/3/2020.

5. Section 80EEB: Interest on Electric Vehicle Loan

Maximum Deduction Limit: 1,50,000 INR

Eligibility Criteria: Amount spent as interest on purchase of Electric Vehicle

This section allows any interest paid towards Electric Vehicle Loan for Loans taken from Banks or Financial Institutions & the loan was sanctioned between 01-04-2019 to 31-03-2021.

6. Section 80GG: Payment of Rent in case of No House Rent Allowance

Maximum Deduction Limit: No Limit

Eligibility Criteria: Amount spent towards rent during the previous year

Any amount paid towards rent for any residential accommodation including furnished will be allowed as a deduction. Deduction to be allowed least of the following:

- Rent Paid in Excess Of 10% Of Total Income

- 20% of Total Income

- INR 5000 Per Month

Be informed that the Total income as mentioned above has a different meaning, we recommend you contact a professional on that regard.

7. Section 24: Deduction On House Property

This section allows the following deductions:

Standard Deduction:

Maximum Deduction: Upto 30% of NAV

Eligibility Criteria: Such property is let out or deemed to be let out and is not a self-occupied property nor used for Business and Profession

A Standard deduction of flat 30% of net annual value is allowed as a deduction.

Interest on Loan:

Maximum Deduction: Up to 2,00,000 For Construction of New & 30,000 For Improvement

Eligibility Criteria: Interest Due on Loan from Financial Institution or Banks for House Property

Any Interest paid for a loan which was used to build, acquire or reconstruct a house property such interest is allowed as a deduction. Pre-Construction interest is allowed in five installments at 20% p.a basis on completion of construction.

8. 80G,80GGA,80GGC: Various Donations including PMCARES Fund

Maximum Deduction: 2000 INR if the donation is made in cash, no upper limit if donation is made through Cheque or banking channels.

Eligibility Criteria: Amount Spent During the Previous year

Section 80G: Donation made to Charitable Organizations, not all donations to charitable organizations are allowed as deductions. So kindly check if such donations carry any tax benefit before making such payment, if you wish to avail such deductions. Maximum deduction at the rate of 100% or 50% is allowed based on the kind of donation made under this scheme.

Section 80GGA: Donation made towards Scientific Research or Rural Development.

Section 80GGC: Donation made to Political Parties.

9. Section 80TTA: Interest On Savings Account

Maximum Deduction: 10,000 INR

Eligibility Criteria: Earned/Accrued During the year

Any Interest Earned on deposits from saving account would be allowed as a deduction. The Interest accrued could be from deposits at a Bank, Post office or a financial co-operative society.

10. Section 80TTB: Interest for senior and super senior citizens

Maximum Deduction: 50,000 INR

Eligibility Criteria: Earned/Accrued During the year

Any Interest Earned on deposits from saving account by a super senior assesse would be allowed as a deduction. The Interest accrued could be from deposits at a Bank, Post office or a financial co-operative society.

Super Senior Citizen would mean any person aged 60 Years and above during the previous year.

Tradeviser, an idea shaped into reality with the motive of helping new businesses and startups with professional guidance end-to-end business services. Ever since its inception since 2016, Team Tradeviser has worked diligently with over 200 startups and been part of their of their sedulous journey to make it to the big picture.