5 Compliances To Be Done For Your LLP In 2022

Updated for FY 2021-22

A separate Legal entity between partners suitable for small business and other than small entities willing to incorporate with no capital requirement. Whereas transfer of ownership is quite simple and easy. Limited Liability Partnership is governed by Limited Liability Partnership Act 2008. It is the fastest used form of business by various business. As everything comes with cost to be paid, Limited Liability Partnership also comes with a negative effect for the business when it comes to compliances, it is to be complied by every LLP every year, irrespective of their transactions.

Annual Compliances For Your LLP

Every Limited Liability Partnership has to comply with mandatory Annual Returns to be filed within 60 days from end of the Financial Statements. The Books of Accounts of every LLP to be closed by 31st March every year.

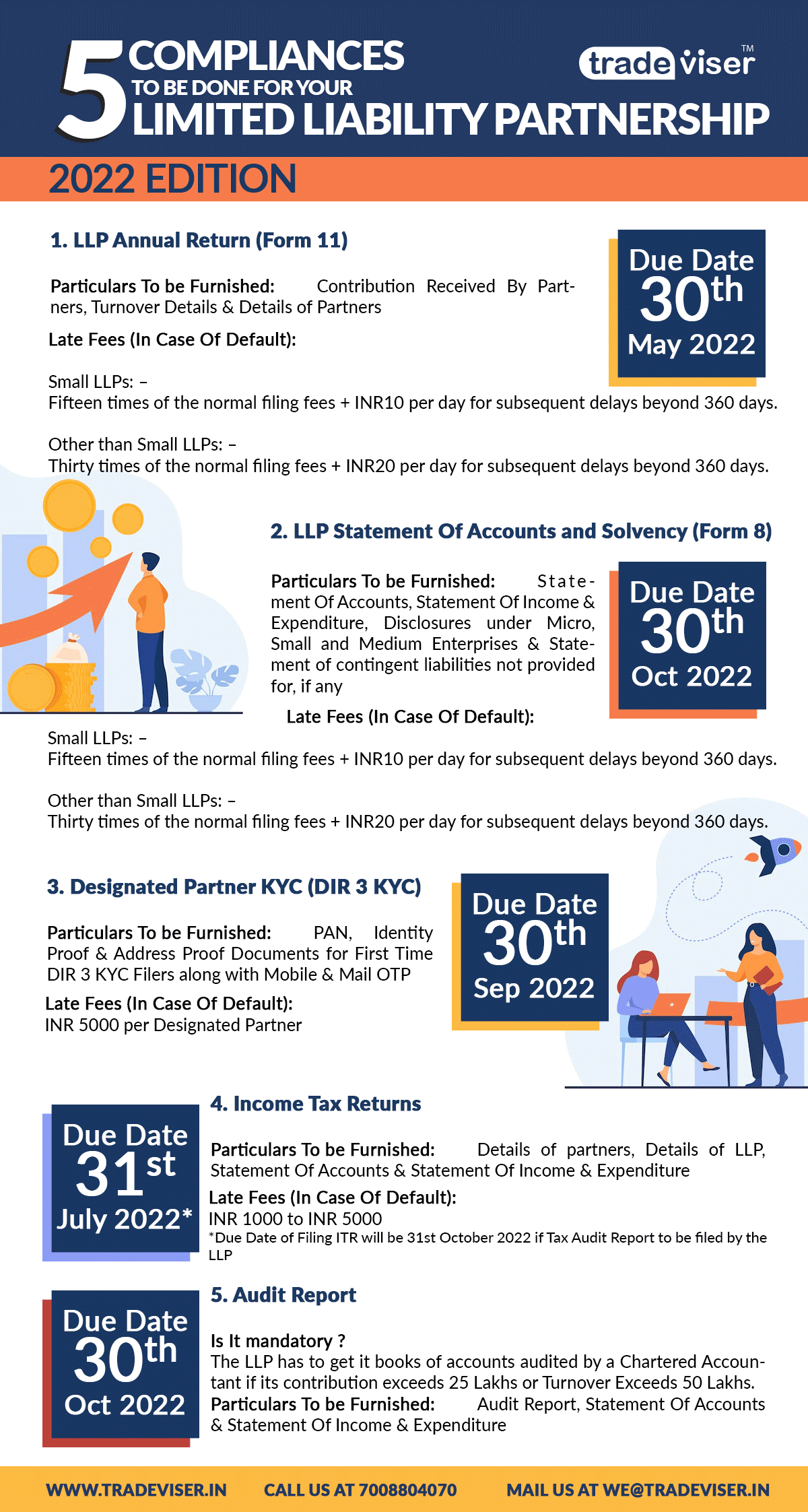

1. LLP Annual Return (Form 11)

Due Date: 30th May 2022

Particulars To be Furnished: Contribution Received By Partners, Turnover Details & Details of Partners

Late Fees (In Case Of Default):

Small LLPs: –

Fifteen times of the normal filing fees + INR10 per day for subsequent delays beyond 360 days.

Other than Small LLPs: –

Thirty times of the normal filing fees + INR20 per day for subsequent delays beyond 360 days.

2. LLP Statement Of Accounts and Solvency (Form 8)

Due Date: 30th October 2022

Particulars To be Furnished: Statement Of Accounts, Statement Of Income & Expenditure, Disclosures under Micro, Small and Medium Enterprises & Statement of contingent liabilities not provided for, if any

Late Fees (In Case Of Default):

Small LLPs: –

Fifteen times of the normal filing fees + INR10 per day for subsequent delays beyond 360 days.

Other than Small LLPs: –

Thirty times of the normal filing fees + INR20 per day for subsequent delays beyond 360 days.

3. Designated Partner KYC (DIR 3 KYC)

Every DIN Holder as on 31st March, 2022 has to comply with the mandatory requirement of filing form DIR-3 KYC/WEB KYC with the Central Government. The DIN holder who has already filed in the Previous Financial year requires to complete the KYC through WEB Form. In case of default The DIN stands “Deactivated due to Non-Filing” in case of Non Filing of the KYC form. It can be Reactivated by Filing DIR-3-KYC with fees of Rs.5000/-

Due Date: 30th September 2022

Particulars To be Furnished: PAN, Identity Proof & Address Proof Documents for First Time DIR 3 KYC Filers along with Mobile & Mail OTP

Late Fees (In case Of Default): INR 5000 per Designated Partner who is in Default

4. Income Tax Returns

Every Limited Liability Partnership is required to file their Income Tax Returns via ITR 5 as a part of Disclosure and disclose their Profit or Loss thereof for the given assessment year. Any Losses can be carried forward only when the Income tax Returns have been filed in time. Additionally the Limited Liability Partnerships will be Liable for Income tax Audits if the Tax Audit Criteria under Section 44AB or 44ABA is matched.

5. LLP Audit Compliance

There is also a requirement for Mandatory Audit of Financial Statements in the Annual Compliance of Limited Liability Partnership depending on the contribution and turnover. The Limited Liability Partnership has to get it books of accounts audited by a Chartered Accountant if its contribution exceeds Twenty Five Lakhs or Turnover Exceeds Fifty Lakhs. The LLP can voluntarily get it books of accounts audited even if her contribution or turnover is below the threshold limit if they wish to.

In order to deal with the non-compliance issue, we have a structured and relevant procedure for filling of Annual Compliance for a Limited Liability Partnership!!!

So, ‘without Further ado’, contact Tradeviser for best Advice relating to your compliances today!!