Understanding ITR 1 SAHAJ: The Easy Way to File Income Tax Returns

Updated for the Assessment year 2023-24

The income tax department has recently released the ITR Forms for the assessment year 2023-24. We understand that it can be confusing to choose the right ITR form, especially if you’re filing your taxes on your own. So, in this article, we’ll explain the ITR 1 SAHAJ form in detail and clarify when you should use it.

The ITR 1 SAHAJ form is named so because it aims to simplify tax filing for regular individuals. It’s designed to be easy to understand and fill out, with just three pages to complete. The main purpose of this form is to make the tax filing process quicker and simpler for everyone. By using the ITR 1 SAHAJ form, you can save time and have a hassle-free experience while fulfilling your tax obligations.

Who can file ITR 1 ?

This form is applicable for individuals who are ordinary residents and have a total income of up to INR 50 lakhs. It allows for filing returns for individuals with income from the following sources:

- Salary/Pension,

- House property (single house property),

- Other Sources (not including winning from lottery or horse race) or

- Agricultural Income up to INR 5 Thousand.

Who cannot file ITR 1 ?

Unlike earlier years from assessment year 2019-20 onwards ITR 1 SAHAJ can only be filed for ordinary resident Individuals. Apart from non-resident or not ordinary residents following assesses cannot file their return of income using ITR 1 SAHAJ:

- Individuals having an Income of INR 50 Lakhs and above,

- Individuals having income from more than one house property,

- Individuals having income or loss from business or profession,

- Individuals having income from capital gains,

- Individuals having income from lottery, horse racing or any form of gambling.

- Individuals having agricultural income of INR 5,000 above,

- An individual holding directorship in any company or having being made investments in any unlisted equity shares,

- Individual claiming relief for any foreign taxes paid or taking relief for double taxation,

- Individuals having assets outside India or signing authority in any account located outside India.

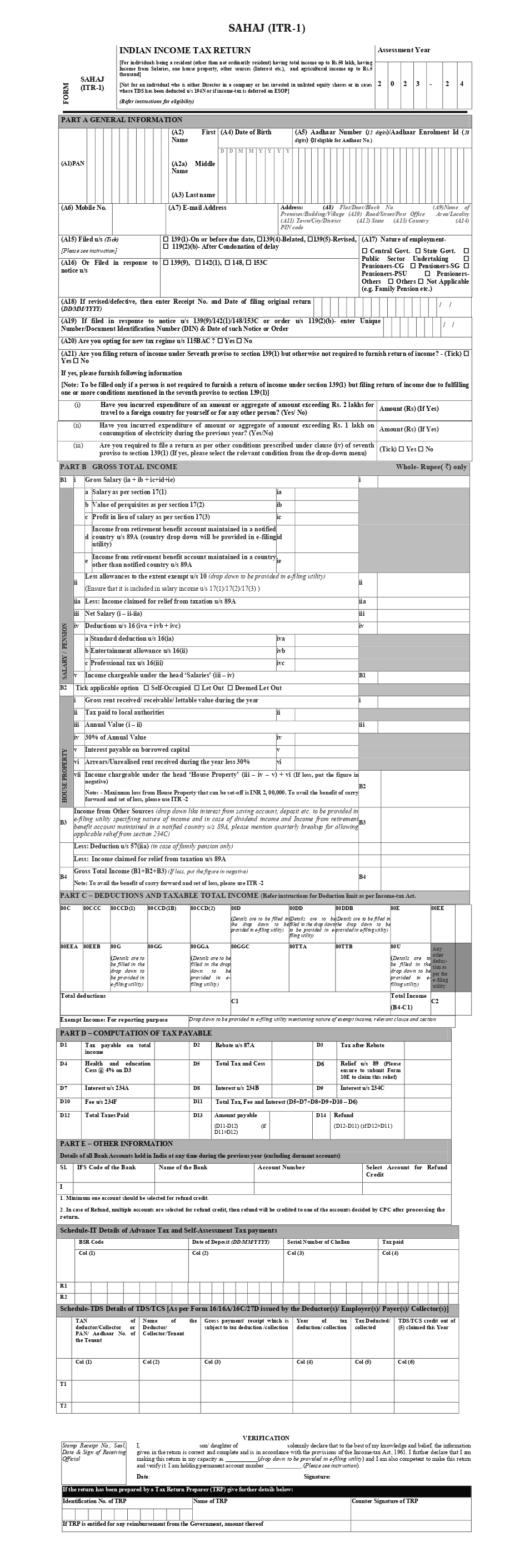

ITR 1 SAHAJ Form Explained

PART A: General Information

Almost all the contents of the form under Part A are self-explanatory. The following points are crucial and need to be checked while drafting your return:

- Point No A20: Please select Yes if you are opting for the New Lower Tax Regime US 115BAC

- Point No A21: Please select Yes, filing return of income under Seventh proviso to section 139(1) if any of the following conditions are met:

- Incurred expenditure of an amount or aggregate amount exceeding Rs. 2 lakhs for travel to a foreign country for yourself or for any other person

- Incurred expenditure of amount or aggregate of the amount exceeding Rs. 1 lakh on the consumption of electricity during the previous year

- If the person has deposited an amount or aggregate of the amounts exceeding one crore rupees in one or more current accounts maintained with a banking company or a cooperative bank;

- If the person has a deposit in one or more savings bank accounts, in aggregate, fifty lakh rupees or more, in the previous year

PART B: Gross Total Income

All the details regarding your income go on in this section. Gross salary, Allowances, and Deductions are to be provided under the head salary under the B1 section. Details of income from house property and other sources have to be provided under B2 & B3.

PART C: Deduction and Taxable Total Income

Details of deduction under sections 80C, 80D, 80G, 80GGA, 80TTA, 80TTB and exempt income are to be provided here.

PART D: Computation of Tax Payable

After arriving at Taxable Total Income the form shall computer Tax payable or refundable by the assesse under this section.

PART E: Other Information, Taxes Paid, TDS/TCS

Bank Account Details: Please provide comprehensive information regarding all active bank accounts held as of the filing date. It is essential to include details of your primary account if you are eligible to receive any tax refunds. Kindly note that if you anticipate a tax refund, ensure that the bank account you provide is linked to your PAN (Permanent Account Number) to avoid potential complications.

Tax Information: Many first-time taxpayers make the common error of solely computing their tax payable and subsequently filing their tax returns. However, it is crucial to emphasize that the computed tax payable should be paid if not paid in advance, and the details of such payments must be provided in this section of the ITR 1 form.

If any Tax Deducted at Source (TDS) or Tax Collected at Source (TCS) has been deducted from your income, please provide the relevant details of the deducted amount in this section.

Corporate Law Practitioner, Working On Rewiring The Compliance Industry, Founder & CEO of Tradeviser.in, I blend my background in Chartered Accountancy with a passion for brand strategy and design. From launching Odishas first English lifestyle magazine to building a platform that has empowered 2,000+ businesses, I’m driven to simplify compliance and help startups grow with confidence.