Complete Guide to DIR 3 KYC Filing for Directors Holding DIN

As a director of a company, you have various compliance requirements that need to be fulfilled to ensure smooth operations and avoid legal repercussions. One such requirement is the filing of DIR 3 KYC (Know Your Customer) form, which is mandatory for all directors holding a Director Identification Number (DIN). In this blog post, we’ll walk you through the process of filing DIR 3 KYC, the documents required, and some important things to keep in mind. By the end of this guide, you’ll have a clear understanding of what DIR 3 KYC is, why it’s important, and how to file it correctly.

Who should file DIR-3 KYC Compliance?

If you are holding a Director Identification Number as on 31st March 2023, irrespective of you holding a Directorship in any Company or Limited Liability Partnership will be required to file the DIR3 KYC Compliance.

For Example:

If you had applied for new Director Identification Number/Incorporation on 21st February 2023 and your DIN/Incorporation was approved on 5th March 2023, which is before 31st March 2023 and hence you will need to file your DIR-3 KYC Compliance for this year before 30th September.

How Do I check my DIN Allotment Date?

Ideally Ministry of Corporate Affairs send DIN Approval letters to the applicant via Mail but if you did not receive the same you can click here and fill in your DIN which should show you your DIN Approval date.

Helpful Tip:

In some instances, we have observed that late fees were levied on DIN holders even if their DIN was approved after 31st March. Therefore, we strongly recommend that you seek the guidance of a qualified expert, even if your DIN was approved after the aforementioned date, to avoid any unexpected late fees.

What are the Documents & Information is required for DIR-3 KYC Filing?

Following are the documents & information required for DIR-3 KYC Compliance:

- DIN Number

- Passport Sized Colour Photo

- PAN Copy

- Aadhar Copy

- Identity proof: Voter ID/Driving License/Passport Copy

- Bank Statement/Utility Bill Latest

- Mail ID & Phone Number for OTP

- Valid Digital Signature Certificate

Foreign national directors will be required to provide documents that have been attested by their respective foreign embassy, or alternatively, obtain an apostle for their documents where applicable.

What is the Due Date for DIR-3 KYC ?

DIR-3 KYC filing for all DIN holders is to be done before 30th September 2023

What are the consequences for non-Filing of DIR-3 KYC ?

If a director fails to file the required e-Form on the MCA 21 portal by the 30th of September, their Director Identification Number (DIN) will be marked as “Deactivated due to Non-filing of DIR-3 KYC” by the department. A Director whose DIN is Deactivated due to non-filing of KYC is not eligible to sign any eForms as a Director of any company. In the event that the director wishes to reactivate their DIN in the future by filing the missed-out eForm DIR-3 KYC, a late fee of Rs 5,000 will be imposed. This fee is applicable from the 30th of September of the year in which the eForm DIR-3 is to be filed and is required to be paid before reactivation. It is important to note that this form needs to be filed annually by all directors.

How to file DIR 3 KYC ?

DIR-3 KYC can be filed by the Directors on their own if they are not filing it for the first time.

Directors who have filed DIR 3 KYC Last year:

Directors who had already filed their DIR-3 KYC last year can simply create a profile in MCA V3 as a director and can get their KYC compliance done by loging in and going to the following:

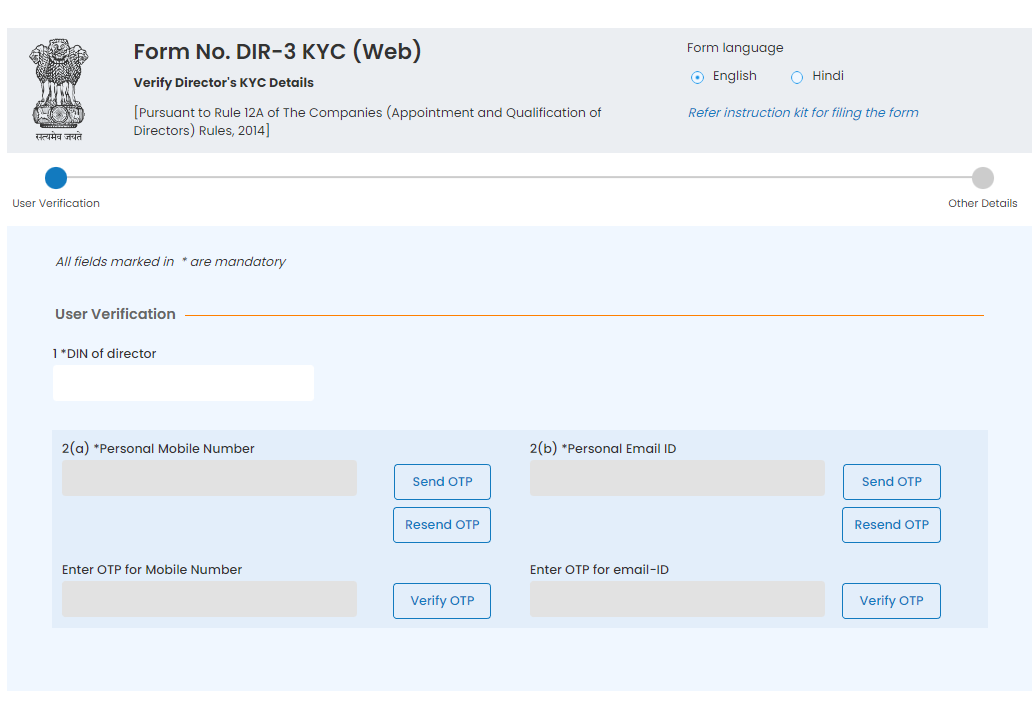

MCA Services >Company e-Filing>DIN Related Filings>Form DIR-3-KYC Web – Verfiy Director’s KYC Details

Once you fill in the DIN you can generate the OTPs and get your KYC done.

Directors who are filing DIR-3 KYC First time:

Directors who are filing DIR-3 KYC for the first time will need to certify and file their DIR-3 KYC form from a certifying professional and hence cannot be done by self.

FAQs for DIR-3 KYC Compliance:

I am holding a DIN but am not currently a Director in any company, should I file DIR 3 KYC?

Yes, DIR3 KYC has to be filed annually irrespective of your Directorship holding status.

When can I file the DIR-3 KYC Compliance?

DIR KYC Compliance for FY 2023-24 is Live and you can complete the same now.

What are the Govt fees for Filing?

For the current year there are no Govt fees for regular KYC filers but default Filers will get Late Fees of INR 5,000

Can I file DIR-3 KYC if your DIN Status says Deactivated due to Non-Filing?

Yes, you can file DIR3KYC even if your DIN is Deactivated due to Non-Filing by paying INR 5,000 late fees.

Can I use the same Mail ID/Phone No for multiple DINs?

No, every DIN must have a Unique Mail ID & Phone Number for OTP Verification.

Can I use Class ii DSC to file DIR-3 KYC?

Yes, if you have a Class ii DSC which was valid before January 1, 2021, and is associated with your DIN, you can file your DIR-3 KYC using the Class ii DSC.

My Phone Number or Mail ID has changed, can I file using Web KYC?

No, you need to either file DIR-3 KYC via eForm or change your Contact details by filing DIR 6 before filing for DIR 3 KYC Compliance.

Our team of experienced professionals are well-versed with the latest regulations and guidelines related to KYC compliance and can assist you in completing the process in a timely and efficient manner. We strive to offer our services at the most competitive prices, starting at just 599 INR. By choosing our services, you can ensure that your KYC compliance is up-to-date and in accordance with the latest regulatory requirements. To avail of our services, simply click the link below to book your slot and our team will take care of the rest.