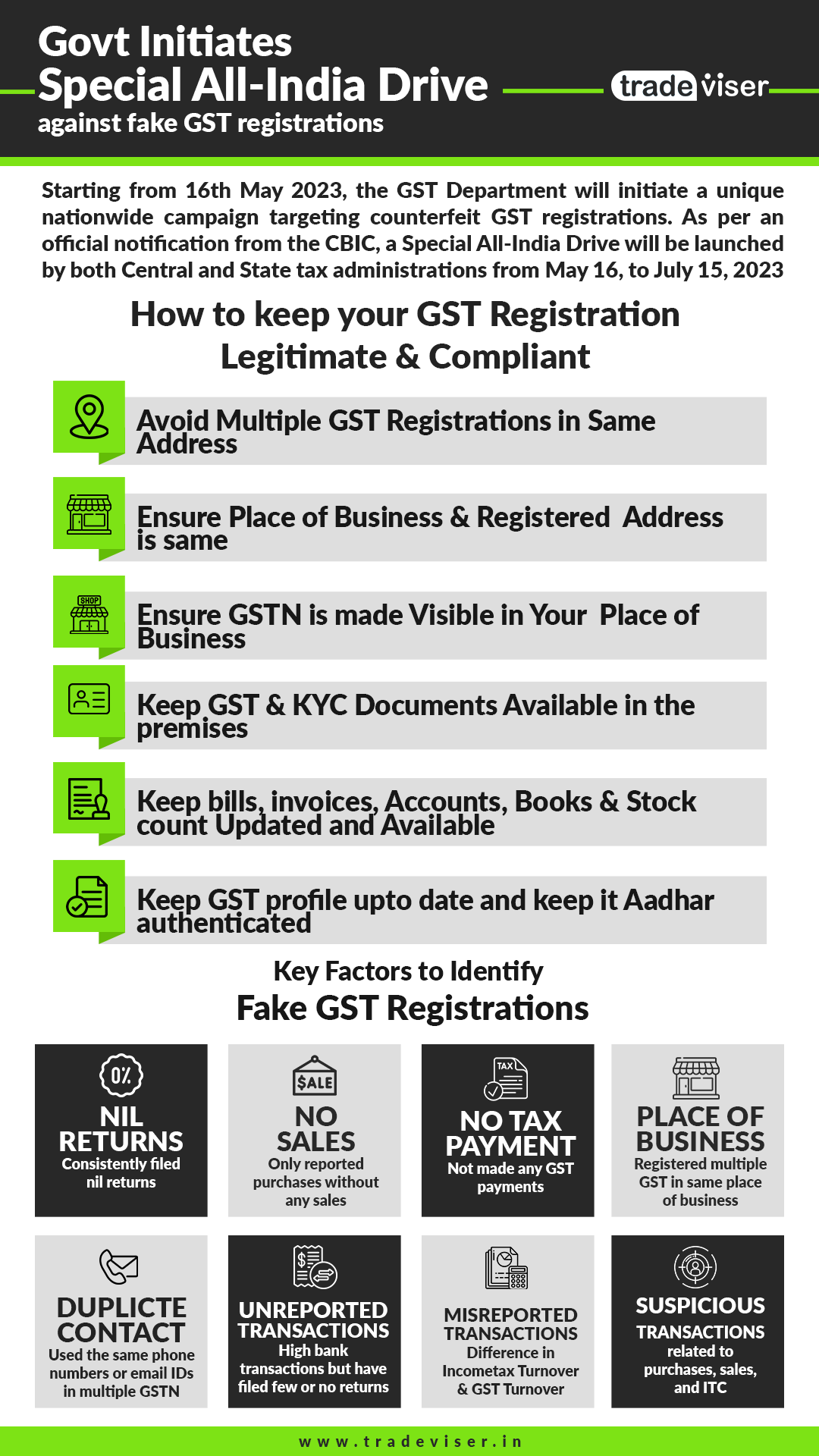

Six Ways To Keep Your Business Safe from Special All-India Drive against fake GST registrations

Starting on 16th May 2023, the GST Department will initiate a unique nationwide campaign targeting counterfeit GST registrations. As per the official notification from the Central Board of Indirect Taxes & Customs (CBIC), a Special All-India Drive will be launched by both Central and State tax administrations from May 16, 2023, to July 15, 2023. The objective of this drive is to identify suspicious/fake GSTINs, conduct necessary verifications, and take appropriate actions to eliminate these fraudulent billers from the GST ecosystem. The primary goal is to protect government revenue. This information was conveyed through an instruction issued to all field formations by CBIC.

Which factors can be used to identify businesses with fake GST registrations?

Under the Special All-India Drive for Fake GST Registrations, the following types of businesses have a higher likelihood of being identified as fake registrations:

- Businesses that have consistently filed nil returns from the beginning or for the past 12 months.

- Businesses that have solely reported purchases without any sales data from the beginning or for the past 12 months.

- Businesses that have not made any GST payments within the last 12 months or since their registration.

- Businesses that have registered multiple times with the same place of business.

- Businesses that have used the same phone numbers or email IDs for multiple GST registrations.

- Businesses with substantial bank transactions have filed few or no GST returns.

- Businesses that declare a turnover on their Income Tax Returns but fail to report similar figures on their GST returns.

- Businesses involved in suspicious transactions related to purchases, sales, and input tax credits.

These criteria might serve as indicators for identifying potential fake GST registrations during the Special All-India Drive.

During the drive, the GSTN (Goods and Services Tax Network) will employ detailed data analytics and risk parameters to identify fraudulent GSTINs (Goods and Services Tax Identification Numbers) for both State and Central Tax authorities. The GSTN will then share the details of these suspicious GSTINs, categorized by jurisdiction, with the respective State/Central Tax administration. This will enable them to initiate a verification process and take necessary actions accordingly.

If, upon thorough verification, it is discovered that a taxpayer is non-existent and fictitious, appropriate measures will be taken to suspend and cancel the registration of the said taxpayer. Furthermore, there will be an examination of the possibility of blocking input tax credits in the Electronic Credit Ledger for such cases. Additionally, efforts will be made to identify the recipients who have received an input tax credit from these non-existing taxpayers.

In cases involving fake GSTINs, actions will also be undertaken to identify the individuals or groups responsible and any beneficiaries involved. This will be done as necessary for further legal action, recovery of government dues, and potentially provisional attachment of properties or bank accounts.

Do the following to keep your GST Registration Legitimate & Compliant:

- Avoid Multiple GST Registrations in the Same Address: To maintain compliance with GST regulations, it is crucial to avoid multiple GST registrations for businesses operating from the same address. In cases where multiple GST businesses are operating from a single address, it is important to ensure a clear demarcation or distinction for each business entity.

- Ensure Place of Business & Registered Address are the same: Numerous registered individuals have been observed conducting business activities from locations other than their principal place of business without registering them, prompting the recommendation to register all such business locations as “Additional Places of Business

- Ensure GSTN is made Visible in Your Place of Business: According to Rule 18 of GST Laws, every Registered Person is obligated to visibly display their GST Registration Number on Name Board & GST Certificate in the Business premises. Failure to comply with this requirement may result in a penalty of Rs. 50,000 under Section 125. It is important to note that there is no specified format for displaying the GST Number.

- Keep Important Documents Available: Ensure that you have readily available the KYC documents of Directors/Partners/Proprietors, business registration documents, rental agreement, latest utility bill, and other relevant headquarters documents in case of a visit by department officials.

- Keep Accounts & Books Updated and Available: Make certain that your bill books, invoices, books of accounts, stock ledgers, and stock count are regularly updated and readily accessible for a prompt audit in the event of a visit.

- Keep Your GST Profile Up to Date: To avoid any discrepancies make sure your GST Profile has updated Bank Details, Registered Office Details, Additional place of Business Details, Goods & Services Details, and Directors/Partners/Proprietor Details & also make sure that the profile is Aadhar authenticated.

In conclusion, as the Special All-India Drive against fake GST registrations begins, it is imperative for businesses to proactively ensure compliance and protect themselves from potential scrutiny. Failure to adhere to the guidelines and recommendations outlined under GST Law can result in substantial penalties and a prolonged process of notices and proceedings that can adversely impact your business. To navigate these challenges smoothly and maintain seamless compliance, we encourage you to reach out to us for expert assistance in managing your business’s compliance requirements.

Corporate Law Practitioner, Working On Rewiring The Compliance Industry, Founder & CEO of Tradeviser.in, I blend my background in Chartered Accountancy with a passion for brand strategy and design. From launching Odishas first English lifestyle magazine to building a platform that has empowered 2,000+ businesses, I’m driven to simplify compliance and help startups grow with confidence.