Clearing Misunderstandings about Income Tax Clearance Certificate (ITCC)

In a new notification, the Central Board of Direct Taxes has allayed fears growing among Indian citizens over whether there is a need to first apply for an Income-Tax Clearance Certificate before leaving the country. According to it, not all Indian citizens are to obtain the certificate, as had been reported wrongly in some sections of the press. The central theme of this blog is to decrypt the key points of clarification given by CBDT and make clear the fact that under which circumstances an ITCC is actually needed.

The Misunderstanding: Do All Indian Citizens Need an ITCC?

There has been widespread misinformation suggesting that every Indian citizen must obtain an ITCC before traveling abroad. This misconception appears to have stemmed from a misinterpretation of recent amendments to Section 230(1A) of the Income-tax Act, 1961, brought about by the Finance (No. 2) Act, 2024. The amendment simply added a reference to the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (commonly referred to as the ‘Black Money Act’) to ensure that liabilities under this Act are treated the same way as liabilities under the Income-tax Act, 1961.

However, this amendment does not impose a blanket requirement for all Indian citizens to obtain an ITCC or file an Income Tax Return. The need for this certificate is conditional and only applies to specific situations, as has been the case since the introduction of this provision in 2003.

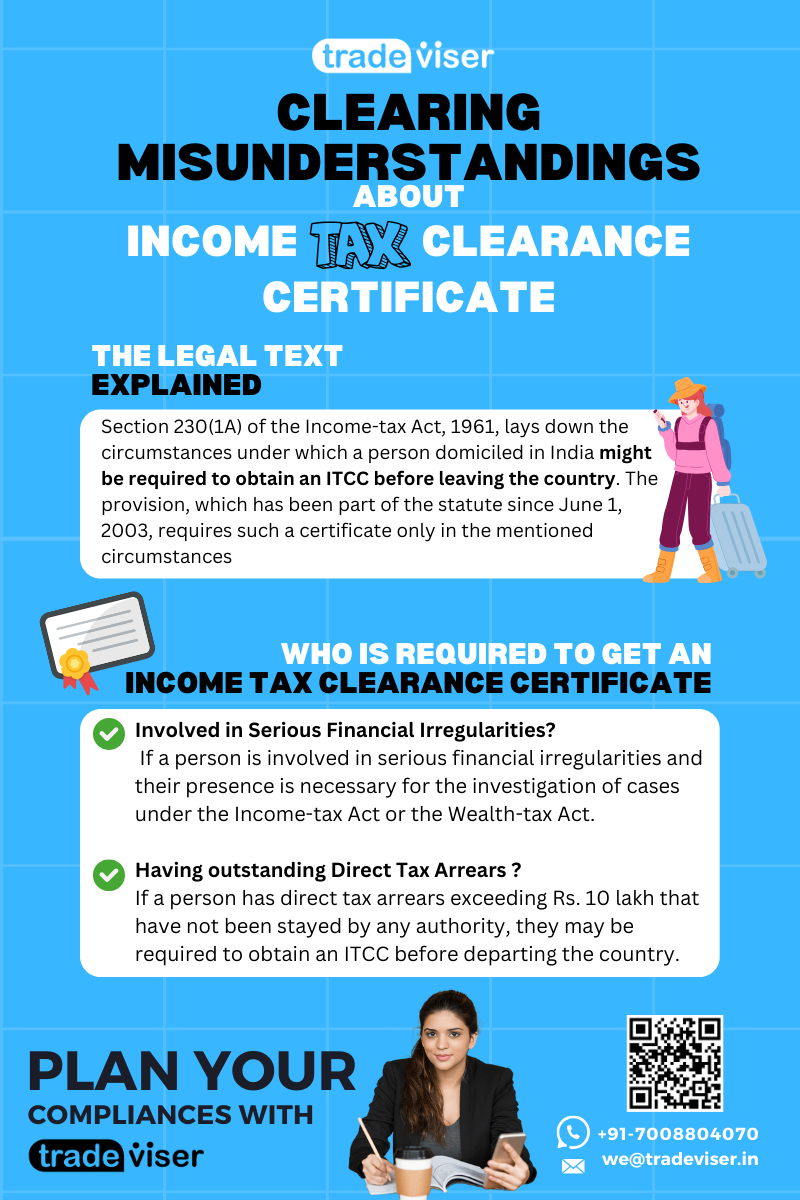

Section 230(1A): What It Actually States

Section 230(1A) of the Income-tax Act, 1961, lays down the circumstances under which a person domiciled in India might be required to obtain an ITCC before leaving the country. The provision, which has been part of the statute since June 1, 2003, requires such a certificate only in the following circumstances:

- Involvement in Serious Financial Irregularities: If a person is involved in serious financial irregularities and their presence is necessary for the investigation of cases under the Income-tax Act or the Wealth-tax Act, an ITCC may be required. This is especially true if there is a likelihood that a tax demand will be raised against them.

- Outstanding Direct Tax Arrears: If a person has direct tax arrears exceeding Rs. 10 lakh that have not been stayed by any authority, they may be required to obtain an ITCC before departing the country.

These conditions have been clearly outlined in the CBDT’s Instruction No. 1/2004, dated February 5, 2004. Furthermore, before requiring an individual to obtain an ITCC, the reasons must be recorded, and approval must be obtained from the Principal Chief Commissioner of Income-tax or the Chief Commissioner of Income-tax.

What This Means for Indian Citizens

For the vast majority of Indian citizens, there is no need to worry about obtaining an ITCC before leaving the country. The requirement is narrowly focused on individuals who fall into one of the two categories mentioned above. This means that unless you are involved in serious financial irregularities or have significant, unstayed tax arrears, you are not required to obtain this certificate.

The confusion seems to have arisen due to a lack of understanding of the specific nature of the amendment made in 2024. The amendment’s primary purpose was to extend the ITCC requirement to cover liabilities under the Black Money Act, aligning it with existing tax liabilities under the Income-tax Act, 1961. However, this does not change the underlying principle that only certain individuals are required to obtain an ITCC.

Conclusion: No Need for Alarm

In conclusion, the CBDT has clearly stated that the requirement for obtaining an ITCC is not a universal mandate for all Indian citizens. It is a provision that applies only in specific circumstances involving serious financial irregularities or significant direct tax arrears. The recent amendment in 2024 does not change this position but merely ensures that liabilities under the Black Money Act are treated similarly to other direct tax liabilities.

If you are an ordinary taxpayer without any major tax issues or involvement in financial irregularities, you can rest assured that there is no need to obtain an ITCC before your travels. This clarification by the CBDT should help dispel any fears or uncertainties surrounding this issue.

Tradeviser, an idea shaped into reality with the motive of helping new businesses and startups with professional guidance end-to-end business services. Ever since its inception since 2016, Team Tradeviser has worked diligently with over 200 startups and been part of their of their sedulous journey to make it to the big picture.