Taxes on Lottery, Puzzles, and Game Show Winnings in India

Winning a lottery, a game show, or a prize contest can be thrilling, but many people overlook the tax implications that come with it. In India, such winnings are taxed at a much higher rate than regular income, and failing to comply with tax laws can lead to serious financial and legal consequences.

This article breaks down the taxation rules, relevant sections of the Income Tax Act, 1961, and strategies to manage tax liabilities effectively.

Taxation of Lottery and Game Show Winnings in India

Under Section 115BB of the Income Tax Act, 1961, winnings from lotteries, game shows, crossword puzzles, card games, betting, gambling, and similar activities are taxed at a flat rate of 30%.

Key Taxation Rules:

- The winnings do not qualify for any exemption or deductions, including the basic exemption limit.

- A flat 30% tax rate applies, irrespective of your total income.

- Section 194B mandates that the organizer deducts TDS at 30% before paying out the prize if the amount exceeds ₹10,000.

- Additional surcharge and cess apply based on the total income.

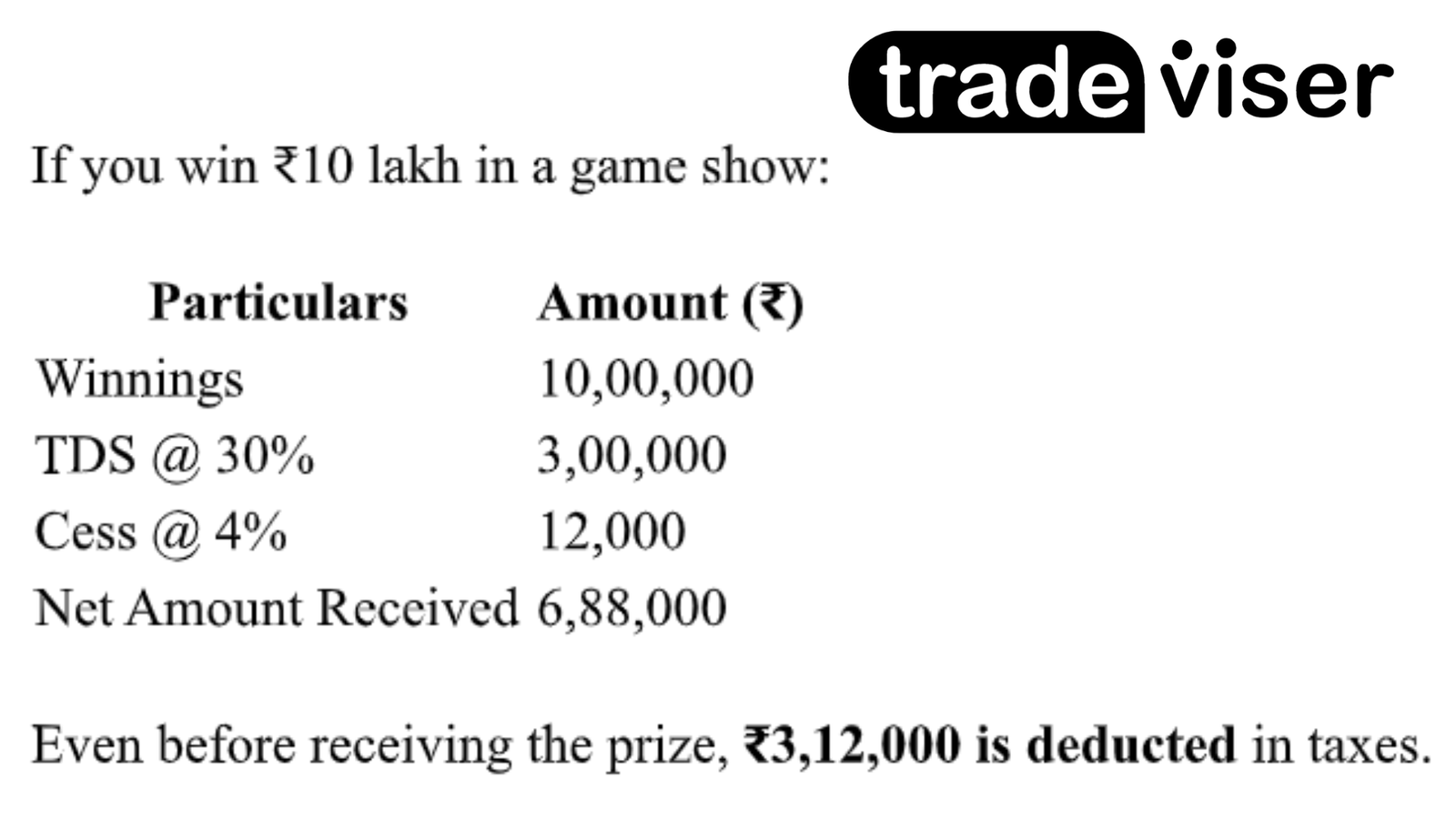

Example of Tax Calculation

Relevant Provisions of the Income Tax Act

1. Section 115BB – Special Tax Rate for Winnings

- A flat 30% tax rate applies, regardless of income slab.

- No deductions under Section 80C, 80D, or any other exemptions are allowed.

2. Section 194B – Tax Deduction at Source (TDS)

- If the winnings exceed ₹10,000, the payer must deduct 30% TDS before payout.

- If the prize is given in kind (car, house, gold, etc.), the winner must pay tax before claiming the prize.

3. Section 271C – Penalty for Non-Payment of Tax

- If winnings are not reported in the Income Tax Return (ITR), a penalty equal to the unpaid tax amount can be levied.

How to Save Taxes on Lottery and Game Show Winnings

Since no exemptions or deductions are allowed under Section 115BB, standard tax-saving options like PPF, ELSS, and insurance do not apply. However, a few strategic steps can help manage tax liabilities:

1. Opt for Winnings in Kind Instead of Cash

If you have a choice, receiving a car, property, or gold instead of cash can delay immediate tax outflow. Ensure the organizer agrees to bear the tax liability, or you will have to pay it yourself.

2. Distribute Winnings Smartly

- Gifts to Family: Transferring post-tax winnings to parents, spouse, or adult children can help in tax planning.

- Investing Under Different Names: Investing in the name of family members with lower tax brackets can reduce long-term tax impact.

3. Invest Wisely After Tax Deduction

Since tax is unavoidable, investing the remaining amount in tax-efficient instruments like tax-free bonds, fixed deposits in family members’ names, or mutual funds can help maximize post-tax returns.

Dos and Don’ts for Handling Lottery and Game Show Winnings

Dos

Ensure TDS Deduction: The payer must deduct 30% TDS before payout—double-check the deduction before accepting the prize.

Report Winnings in Your ITR: Use ITR-2 or ITR-3 to declare winnings under “Income from Other Sources.”

Consult a Tax Expert: Large winnings may trigger surcharge, advanced tax payments, and scrutiny—professional guidance can help optimize liabilities.

Don’ts

- ✘ Do Not Hide Winnings: Lottery and game show organizers report payouts to the Income Tax Department. Not declaring winnings can lead to tax notices and penalties.

- ✘ Do Not Invest Without a Plan: Receiving a lump sum can be tempting, but investing blindly can lead to unnecessary tax liabilities.

- ✘ Do Not Assume Winnings Are Tax-Free: Unlike agricultural income or long-term capital gains, lottery winnings are always taxable, regardless of the amount.

Final Thoughts: Be Tax-Smart with Your Winnings

Winning a lottery or a game show is exciting, but without proper tax planning, a significant portion of the prize can go towards taxes. While no direct exemptions exist, strategic planning—such as gifting, reinvestment, and tax-efficient investments—can help optimize post-tax gains.

If you’ve won a significant amount and need guidance on how to handle tax liabilities efficiently, consulting a tax expert is the best course of action.

Need expert tax advice? Click below to book an appointment with a tax expert today.

Tradeviser, an idea shaped into reality with the motive of helping new businesses and startups with professional guidance end-to-end business services. Ever since its inception since 2016, Team Tradeviser has worked diligently with over 200 startups and been part of their of their sedulous journey to make it to the big picture.

Ensure TDS Deduction: The payer must deduct 30% TDS before payout—double-check the deduction before accepting the prize.

Ensure TDS Deduction: The payer must deduct 30% TDS before payout—double-check the deduction before accepting the prize.