Professional Tax in Tamil Nadu – A Complete Guide

What is Professional Tax?

Professional Tax (PT) is a state-imposed tax on salaried employees, self-employed individuals, and businesses for carrying out a profession, trade, or employment. It is levied under the Tamil Nadu Tax on Professions, Trades, Callings, and Employments Act, 1992 and is collected by municipal corporations and local bodies.

Who Needs to Pay Professional Tax in Tamil Nadu?

Professional Tax is applicable to:

- Salaried Employees (working in private or government sectors)

- Self-Employed Professionals (Doctors, Lawyers, Chartered Accountants, Consultants, Engineers, etc.)

- Business Owners (Proprietors, Firms, LLPs, and Companies)

- Traders & Freelancers

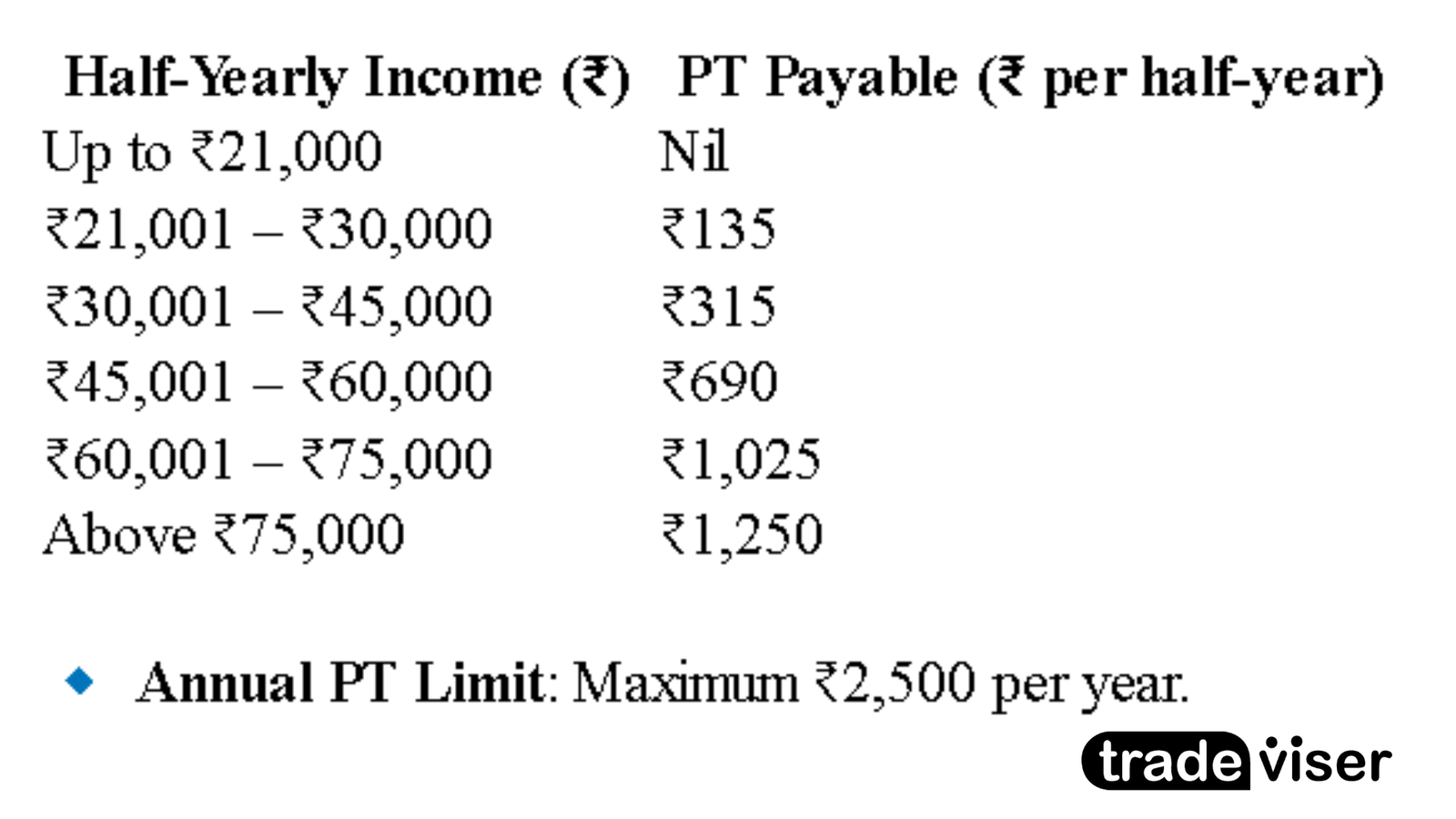

Professional Tax Slabs in Tamil Nadu (As Per Latest Rates)

Tamil Nadu levies PT bi-annually (twice a year), and the tax is determined based on the half-yearly income:

Registration for Professional Tax in Tamil Nadu

- Employers must obtain a Professional Tax Registration Certificate (PTRC) to deduct PT from employees’ salaries.

- Self-Employed Individuals & Businesses must obtain a Professional Tax Enrollment Certificate (PTEC) and pay the tax directly.

How to Register?

- Visit the respective municipal corporation website (Example: Chennai Corporation).

- Apply for PTRC (for employers) or PTEC (for self-employed persons).

- Submit business documents, ID proof, and address proof.

- Once approved, you will receive a PT registration number.

Payment & Due Dates for Professional Tax in Tamil Nadu

- Salaried Employees – Employers must deduct and pay PT every six months (before September 30 & March 31).

- Self-Employed Individuals – PT must be paid annually before 31st March.

Consequences of Non-Payment of PT

Failure to register, deduct, or pay Professional Tax in Tamil Nadu can lead to:

- ✅ Late Fee & Interest – 1.25% per month of the due amount.

- ✅ Penalty – ₹1,000 for failure to register and ₹5 per day for delayed payment.

- ✅ Legal Action – The government can take recovery actions.

Exemptions from Professional Tax in Tamil Nadu

Certain individuals are exempted from paying PT, including:

- Senior citizens (aged 65 years and above)

- Parents or guardians of mentally disabled children

- Members of the Armed Forces

- Individuals with permanent physical disabilities

Conclusion

Professional Tax is mandatory in Tamil Nadu for salaried individuals, self-employed professionals, and businesses earning above ₹21,000 in six months. Proper registration, timely payment, and compliance with municipal regulations are essential to avoid penalties.

Need expert guidance on tax planning? Click below to book a consultation with our tax expert today.

Tradeviser, an idea shaped into reality with the motive of helping new businesses and startups with professional guidance end-to-end business services. Ever since its inception since 2016, Team Tradeviser has worked diligently with over 200 startups and been part of their of their sedulous journey to make it to the big picture.