Professional Tax in Madhya Pradesh – A Complete Guide

What is Professional Tax?

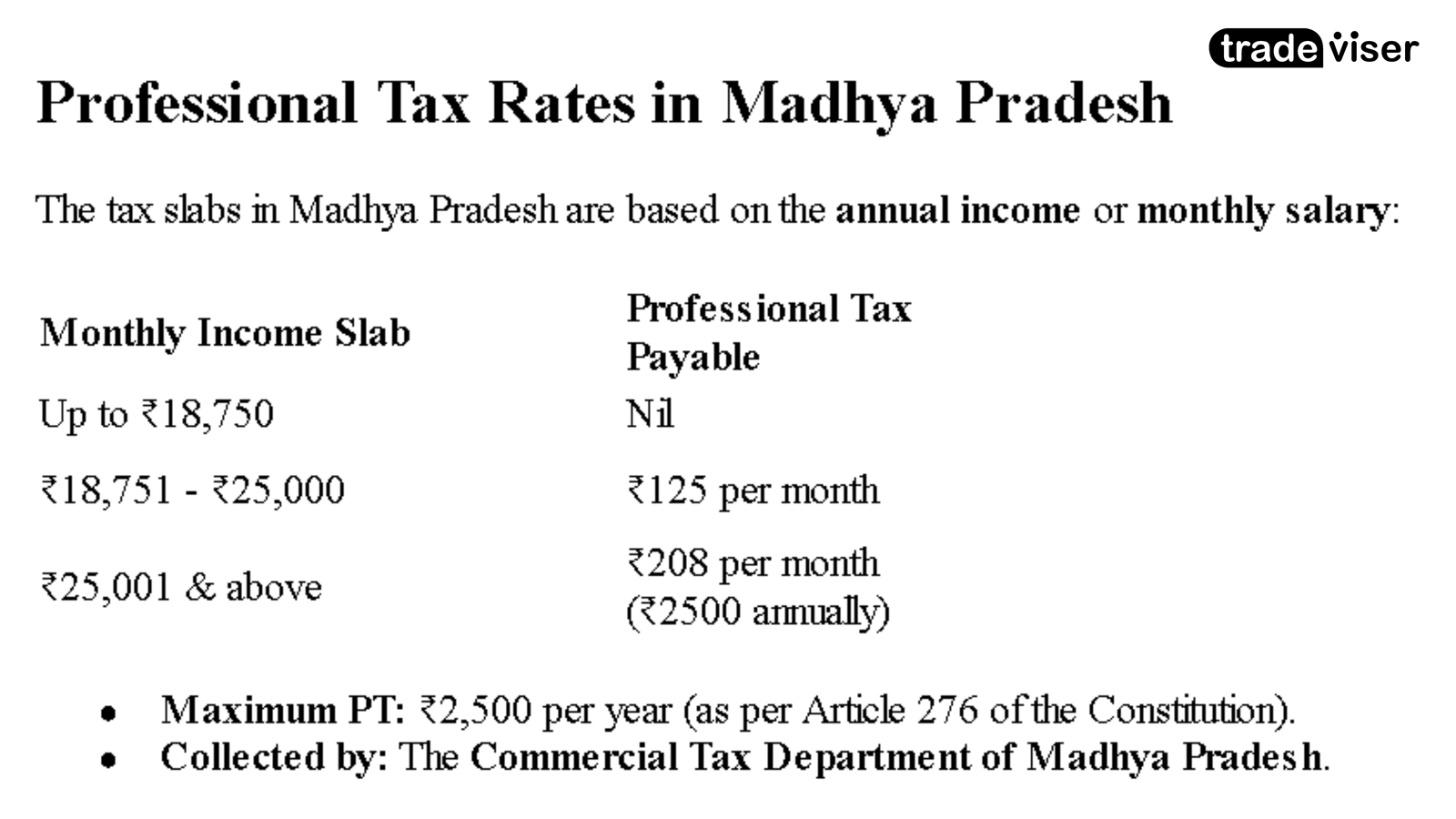

Professional Tax (PT) is a state-imposed tax levied on individuals earning income through salaries, businesses, professions, and trades. In Madhya Pradesh, the tax is governed by The Madhya Pradesh Vritti Kar Adhiniyam, 1995 (Professional Tax Act).

Applicability of Professional Tax in Madhya Pradesh

Professional Tax in Madhya Pradesh applies to:

- Salaried Individuals: Employees working in private and government sectors.

- Self-Employed Professionals: Individuals engaged in business or professions like doctors, lawyers, accountants, and consultants.

- Traders and Business Owners: Those operating businesses such as shops, factories, and commercial establishments.

Due Date for Professional Tax Payment

For Employers:

- Deduct PT from employees’ salaries and deposit it on or before the 10th of the following month.

For Self-Employed Individuals:

- Annual PT payment is due by 30th June each year.

Professional Tax Registration in Madhya Pradesh

For Employers:

- Register under MP Professional Tax Act through the Madhya Pradesh Commercial Tax Department.

- Obtain a Professional Tax Registration Certificate (PTRC).

- File PT returns and make monthly payments.

For Self-Employed Individuals & Businesses:

- Register and obtain a Professional Tax Enrolment Certificate (PTEC).

- Pay tax annually.

Penalties for Non-Compliance

- Late Payment: Interest at 2% per month.

- Failure to Register: Heavy penalties may apply.

- Incorrect Filing: Additional fines may be levied.

How to Pay Professional Tax in Madhya Pradesh?

- Visit the Madhya Pradesh Commercial Tax Department website: mptax.mp.gov.in.

- Login using credentials.

- Select Professional Tax Payment.

- Enter details and proceed with payment.

- Generate challan for records.

Conclusion

Professional Tax compliance is mandatory for businesses and self-employed individuals in Madhya Pradesh. Timely registration and payment help avoid penalties and ensure smooth operations.

Need expert guidance on tax planning? Click below to book a consultation with our tax expert today.

Tradeviser, an idea shaped into reality with the motive of helping new businesses and startups with professional guidance end-to-end business services. Ever since its inception since 2016, Team Tradeviser has worked diligently with over 200 startups and been part of their of their sedulous journey to make it to the big picture.