Professional Tax in Nagaland – A Complete Guide

What is Professional Tax?

Professional Tax (PT) is a state-level tax levied on individuals earning income through salaried employment, business, trade, or professions. In Nagaland, it is governed by The Nagaland Professions, Trades, Callings, and Employments Taxation Act, 1968.

Who is Liable to Pay Professional Tax in Nagaland?

Professional Tax is applicable to:

- Salaried Employees – Government & private sector employees.

- Self-Employed Professionals – Doctors, CAs, lawyers, engineers, consultants, etc.

- Business Owners & Traders – Shops, commercial establishments, and service providers.

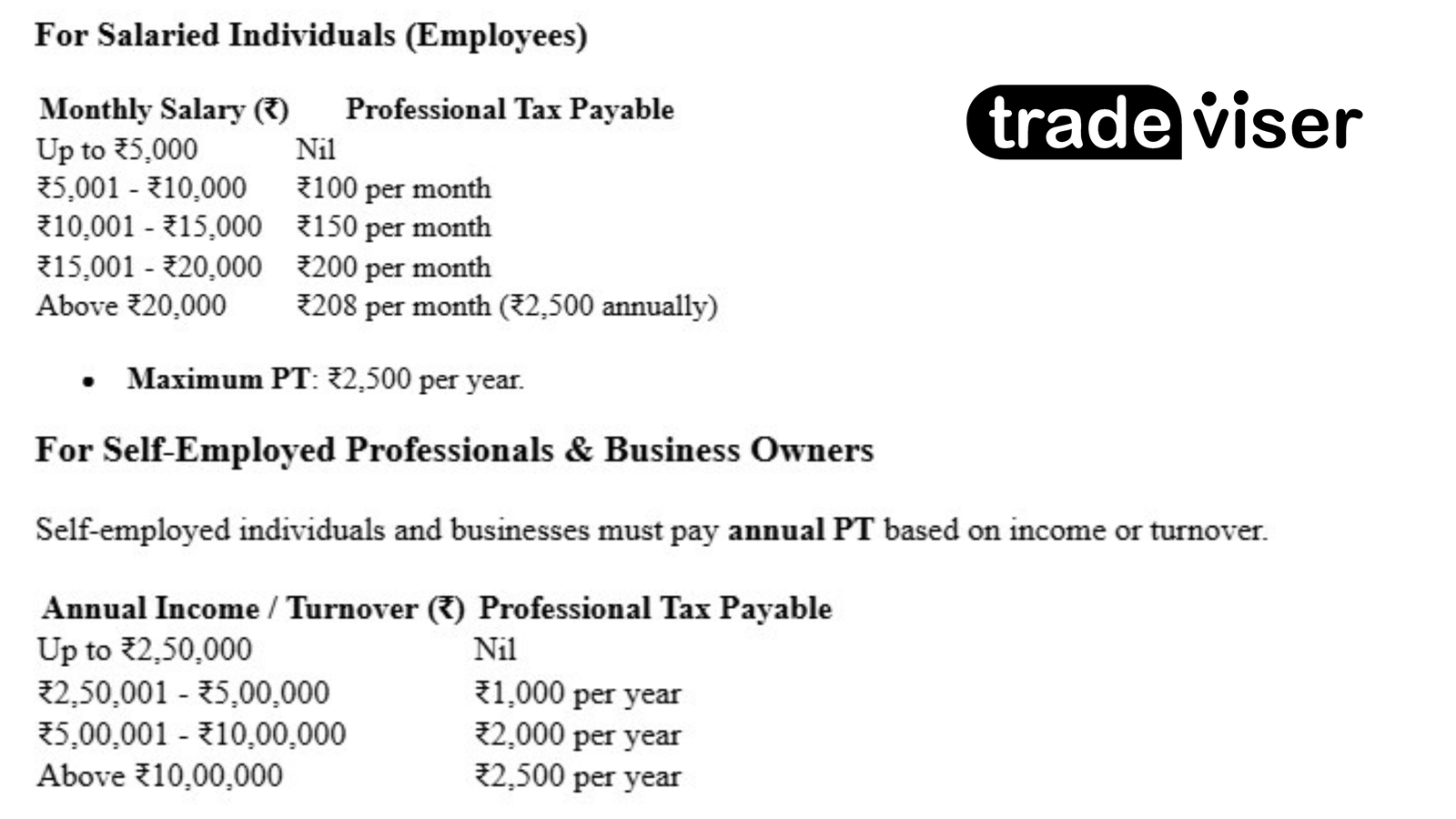

Professional Tax Rates in Nagaland (FY 2024-25)

The tax slabs for salaried individuals and self-employed professionals are:

Professional Tax Registration in Nagaland

For Employers:

- Register for Professional Tax Registration Certificate (PTRC) to deduct PT from employees’ salaries.

For Self-Employed Professionals & Businesses:

- Obtain a Professional Tax Enrollment Certificate (PTEC) to pay PT annually.

Steps for Registration

- Visit the Nagaland Taxation Department website or office.

- Submit the application along with required documents (PAN, Aadhaar, Business Registration, etc.).

- Receive the registration certificate after verification.

Due Dates for Professional Tax Payment

For Employers (PTRC Holders):

- Monthly payment before the 15th of the following month.

- If annual PT liability is ₹50,000 or more, payment is monthly.

- If less than ₹50,000, payment is annually before March 31.

For Self-Employed Individuals (PTEC Holders):

- Annual payment before June 30.

Penalties for Non-Compliance

- Late Payment: Interest at 1.25% per month.

- Failure to Register: Penalty up to ₹5 per day.

- Incorrect Filing: Additional penalties may be levied.

How to Pay Professional Tax in Nagaland?

- Visit the Nagaland Taxation Department Portal.

- Log in and select Professional Tax Payment.

- Enter payment details and proceed with payment.

- Download and save the payment challan.

Conclusion

Professional Tax in Nagaland is mandatory for employees, self-employed professionals, and businesses. Employers must deduct and deposit PT, while self-employed individuals must register and pay annually.

Need expert guidance on tax planning? Click below to book a consultation with our tax expert today.

Tradeviser, an idea shaped into reality with the motive of helping new businesses and startups with professional guidance end-to-end business services. Ever since its inception since 2016, Team Tradeviser has worked diligently with over 200 startups and been part of their of their sedulous journey to make it to the big picture.