How to Declare Foreign Shares in ITR: A Complete Guide

In recent years, more Indian residents have started investing in global markets, especially in foreign shares such as US stocks. While international investing offers exciting opportunities, it also brings with it the responsibility to report such assets accurately to the Indian Income Tax Department.

If you are a resident individual who holds shares or other financial interests in companies outside India, it is mandatory to disclose those holdings in your income tax return (ITR). In this article, we’ll guide you through how to declare foreign shares in ITR, which forms to use, and what to keep in mind for full compliance.

Who Needs to Declare Foreign Shares?

The requirement to disclose foreign shares applies to resident and ordinarily resident (ROR) individuals under Indian tax laws.

If you qualify as ROR and hold:

-

Equity shares of a foreign company

-

Employee stock options (ESOPs) from a foreign employer

-

Mutual funds or exchange-traded funds (ETFs) listed abroad

-

Beneficial ownership in foreign entities

You are required to report these holdings in your income tax return, regardless of whether they generate income or not.

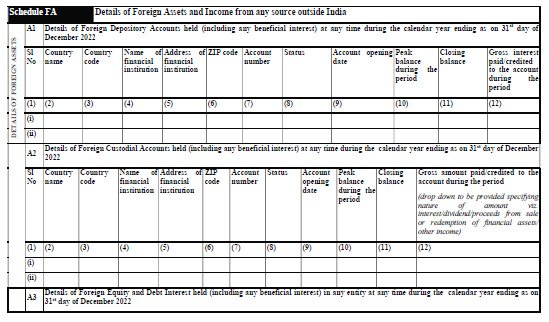

Where to Disclose: Understanding Schedule FA

The reporting of foreign assets is done under Schedule FA (Foreign Assets) in the income tax return. Schedule FA is a specific section introduced by the Income Tax Department to enhance transparency in international holdings.

Under this section, you must provide details such as:

-

Country name and code

-

Name and address of the foreign entity

-

Nature of the asset (e.g. equity shares)

-

Date of acquisition

-

Total investment amount

-

Income generated, if any

-

Nature of ownership (direct or beneficial)

Applicable ITR Forms for Reporting Foreign Shares

Not all ITR forms allow for foreign asset disclosure. Here’s a breakdown of which forms to use:

1. ITR-2

Use this if you are a salaried individual or have income from capital gains, but do not have income from business or profession. ITR-2 allows for foreign asset disclosure under Schedule FA.

2. ITR-3

Applicable if you have income from a business or profession and need to declare foreign shares along with your business income.

3. ITR-4 (Not Applicable)

This form is for individuals under presumptive taxation. It does not include Schedule FA. Hence, if you hold foreign shares, avoid using ITR-4.

Taxation of Foreign Shares

Foreign shares may generate income in the form of:

-

Dividends (taxable in India, generally as per slab)

-

Capital Gains when sold (taxable based on holding period and applicable rates)

You must declare such income under the relevant heads:

-

Income from Other Sources for dividends

-

Capital Gains for profits on sale

India has Double Taxation Avoidance Agreements (DTAAs) with several countries. If tax has already been deducted abroad, you may be eligible for credit against Indian taxes through Form 67.

Consequences of Non-Disclosure

Failure to report foreign shares can lead to:

-

Heavy penalties under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015

-

Notices and scrutiny from the Income Tax Department

-

Possible prosecution if the non-disclosure is willful

The law treats even minor non-compliance seriously. Hence, voluntary and accurate disclosure is always the better route.

Additional Tips

-

Keep all documentary evidence such as broker statements, ESOP details, and tax payment slips for foreign income

-

Report even if there is no income generated from the foreign shareholding

-

If you are unsure about your residential status or whether your asset qualifies as a foreign asset, consult a tax advisor

Final Thoughts

Reporting foreign shares in your ITR is not optional—it is a legal obligation under Indian tax laws. With global investments becoming increasingly common, the Income Tax Department has strengthened its oversight on offshore assets.

By using the correct ITR form and filling out Schedule FA accurately, you stay compliant and protect yourself from unnecessary scrutiny.

Need Help Declaring Your Foreign Shares?

Tradeviser can help you file your return correctly, ensure accurate foreign asset reporting, and avoid legal complications.

Get in touch with our tax experts today for stress-free ITR filing and Schedule FA compliance.

Corporate Law Practitioner, Working On Rewiring The Compliance Industry, Founder & CEO of Tradeviser.in, I blend my background in Chartered Accountancy with a passion for brand strategy and design. From launching Odishas first English lifestyle magazine to building a platform that has empowered 2,000+ businesses, I’m driven to simplify compliance and help startups grow with confidence.