What is Form 15CB? A Complete Guide to CA Certificate for Foreign Remittance

Sending money outside India is subject to strict compliance regulations under the Income Tax Act. If you’re a business or an individual making foreign payments, especially for import of services, royalty, commission, or dividends, you’ve likely come across Form 15CB. This form is a Chartered Accountant’s certificate that plays a key role in validating that the applicable tax on such remittances has been deducted before the funds are sent abroad.

In this article, we’ll break down the purpose, applicability, and filing process of Form 15CB under Rule 37BB of the Income Tax Rules, 1962.

What is Form 15CB?

Form 15CB is a certificate issued by a Chartered Accountant (CA) that certifies the rate and nature of tax deduction on a foreign remittance. It is governed by Section 195 of the Income Tax Act and is required when a remittance is chargeable to tax and the amount exceeds ₹5 lakh in a financial year.

The certificate serves two main purposes:

-

Certifies TDS compliance for foreign remittance

-

Ensures tax liability has been calculated accurately

-

Supports the filing of Form 15CA (Part C)

It includes key details like nature of the transaction, rate of TDS, tax treaty benefits (if any), and tax residency status of the recipient.

When is Form 15CB Required?

Form 15CB is mandatory when the following conditions are met:

-

The remittance exceeds ₹5 lakh in a financial year

-

The remittance is chargeable to tax in India

-

It is not covered under the list of 33 specified exempted payments under Rule 37BB

In such cases, you must first obtain a Form 15CB certificate from a Chartered Accountant, before filing Form 15CA (Part C) online on the income tax portal.

Example:

-

Sending ₹8 lakh as royalty to a company in the US

-

Commission of ₹6 lakh to a non-resident marketing agent

-

Payment for technical services abroad

When is Form 15CB Not Required?

Form 15CB is not required if:

-

The remittance is below ₹5 lakh in a financial year

-

The remittance is not chargeable to tax in India

-

The transaction falls under the list of 33 specified exempted categories, such as:

-

Travel expenses for business/conference

-

School fees of children abroad

-

Purchase of goods from non-residents

-

Import payments

-

In such cases, the taxpayer only needs to file Form 15CA (Part A or B), depending on the scenario.

How Form 15CB Relates to Form 15CA

Form 15CA and Form 15CB go hand-in-hand. Here’s how:

| Scenario | Form to be Filed | CA Certificate (15CB) Required? |

|---|---|---|

| Amount ≤ ₹5 lakh & taxable | Form 15CA Part B | No |

| Amount > ₹5 lakh & taxable | Form 15CA Part C | Yes |

| Not taxable under IT Act | Form 15CA Part D | No |

The information in Form 15CB is used as the basis to complete Form 15CA (Part C).

Information Required for Filing Form 15CB

To prepare Form 15CB, a Chartered Accountant will typically ask for the following documents:

-

Name and address of the remitter and recipient

-

PAN and TAN of the remitter

-

Nature and purpose of remittance

-

Amount to be remitted

-

Details of TDS (rate, amount, section)

-

Tax residency certificate (TRC) of the foreign recipient

-

Copy of the agreement or invoice

-

Details of DTAA (if applicable)

How to File Form 15CB

-

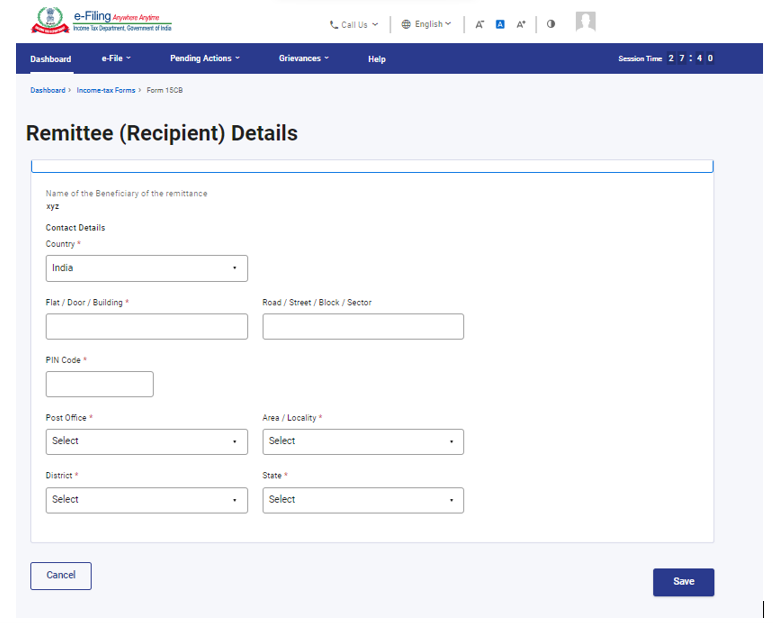

Login to the Income Tax e-Filing Portal with CA credentials

-

Navigate to e-File > Income Tax Forms > File Income Tax Forms

-

Select Form 15CB

-

Fill all required details, attach supporting documents

-

Validate using Digital Signature Certificate (DSC)

-

Submit the form online

Once Form 15CB is successfully submitted, its acknowledgment number is used by the remitter to file Form 15CA (Part C).

Penalty for Non-Filing or Incorrect Filing

Non-compliance with Rule 37BB can attract heavy penalties:

-

Penalty of ₹1 lakh for failure to furnish correct and complete information in Form 15CA/CB

-

Risk of delayed remittance or regulatory scrutiny

Therefore, timely consultation with a qualified CA is essential.

Recent Updates

-

From FY 2023-24, the Income Tax Department has increased surveillance on foreign remittances and LRS compliance.

-

Banks may refuse to process foreign transactions without a valid 15CA and 15CB, if applicable.

-

CAs must digitally verify and maintain logs of their certifications as per ICAI guidelines.

FAQs

1. What is Form 15CB used for?

Form 15CB certifies the rate and deduction of TDS on foreign remittance by a CA. It ensures compliance with Section 195 of the Income Tax Act.

2. Who is required to file Form 15CB?

Any person making a taxable foreign remittance above ₹5 lakh in a financial year needs to get Form 15CB from a CA.

3. Is Form 15CB required for all remittances?

No. It is not required if the remittance is not taxable or is below ₹5 lakh annually.

4. Can an individual file Form 15CB?

Only a Chartered Accountant can issue and file Form 15CB. Individuals need to consult a CA.

5. What happens if I remit funds without Form 15CB?

Non-compliance may result in penalties and the bank may refuse to process the remittance.

6. What documents are needed to issue Form 15CB?

Key documents include invoice/agreement, PAN, TAN, TRC, TDS calculation, and DTAA details.

7. What is the validity of Form 15CB?

There is no specific validity period, but it must be used for the remittance linked to the certificate.

8. Is digital signature required for Form 15CB?

Yes, it must be digitally signed by a CA before submission.

9. What is the difference between Form 15CA and 15CB?

15CA is a self-declaration by the remitter, while 15CB is a CA certification supporting the declaration.

10. Can I revise Form 15CB after submission?

Once submitted, Form 15CB cannot be revised. Any errors must be addressed with the Income Tax Department manually.

Need Help Filing Form 15CA or 15CB?

Navigating foreign remittance compliance can be tricky but you don’t have to do it alone. At Tradeviser, our team of Chartered Accountants and compliance experts specialize in end-to-end assistance for international transactions, Form 15CA/CB filing, FEMA advisory, and tax planning.

Reach out to Tradeviser today for expert consultation and ensure your remittances are smooth, compliant, and penalty-free.

CA Madhusmita Padal is a Practicing Chartered Accountant with firms based in Odisha and Chennai. She specializes in taxation, company law, and auditing. She is passionate about simplifying complex concepts and making knowledge accessible to all.