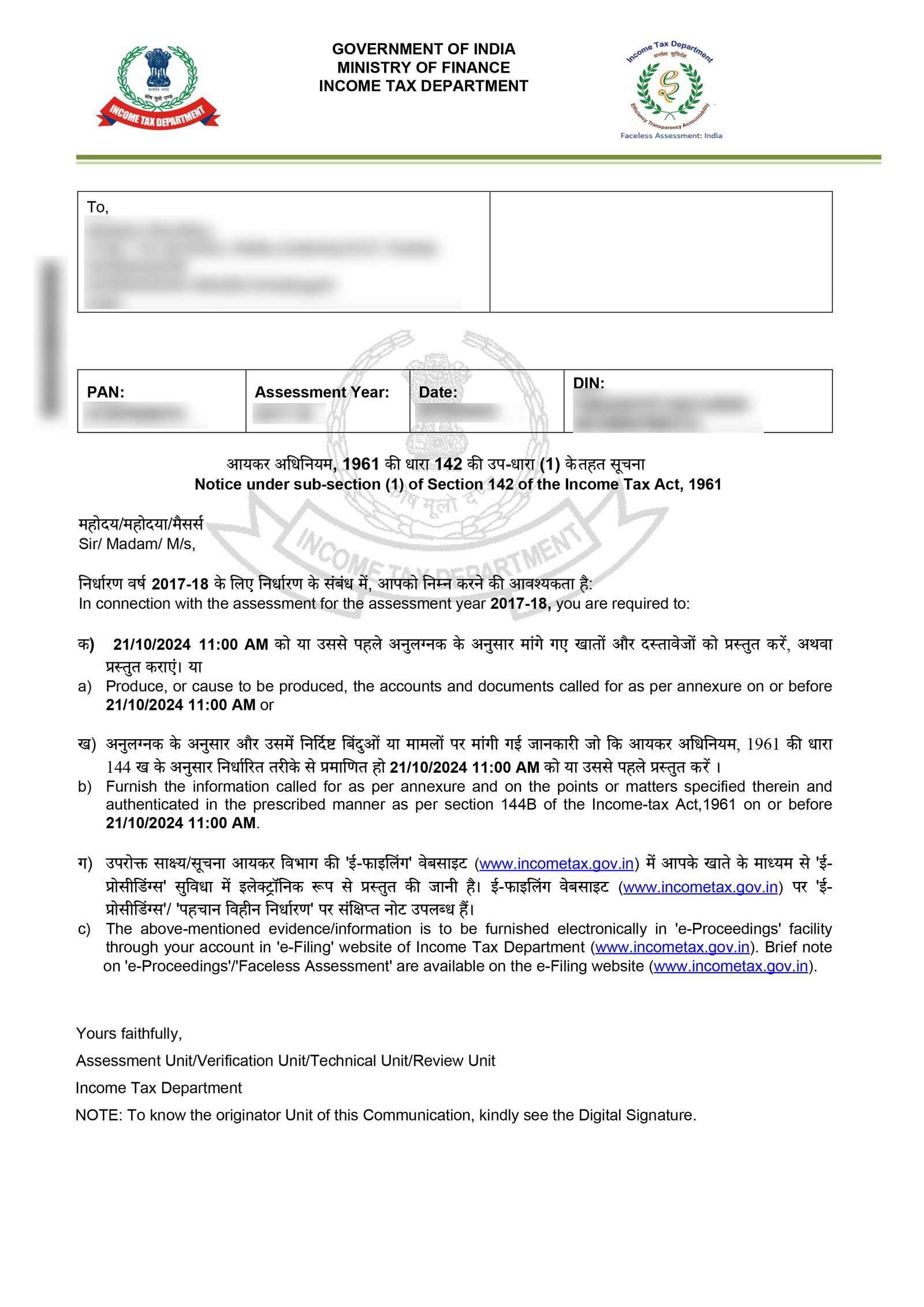

Income Tax Notice Under Section 142(1): What You Need to Know

The Income Tax Department is increasingly using digital tools and data analytics to improve tax compliance. One of the first steps in this process is the issuance of a notice under Section 142(1) of the Income Tax Act, 1961. This notice can be issued to both individuals and businesses for various reasons — from missing returns to clarifying information submitted in your Income Tax Return (ITR).

Understanding the intent, scope, and your responsibilities under Section 142(1) is essential to avoid penalties and ensure timely compliance.

What Is a Section 142(1) Income Tax Notice?

Section 142(1) of the Income Tax Act empowers the Assessing Officer (AO) to serve a notice for the purpose of:

-

Gathering additional information from the taxpayer

-

Requiring the filing of a pending return

-

Asking for books of accounts or other documents to support the return

The notice is typically issued before an assessment is made, meaning it’s a preliminary step and not an accusation. The taxpayer is required to respond within the time specified in the notice.

Reasons Why a Section 142(1) Notice May Be Issued

There are two primary reasons why the tax department may send a notice under this section:

1. Return Not Filed

If you haven’t filed your ITR within the due date, the AO can issue a notice under Section 142(1) requiring you to do so. This is a legal obligation, and non-compliance can lead to penalties and prosecution.

2. Additional Information or Documents Required

If you have filed your return, but the AO needs:

-

Clarifications on declared income,

-

Proof of deductions/exemptions,

-

Details of large or suspicious transactions,

then a Section 142(1) notice may be issued to seek these details.

In both cases, the goal is to enable the officer to accurately assess your tax liability.

How to Respond to a 142(1) Income Tax Notice

Step-by-Step Response Process:

-

Login to the Income Tax Portal.

-

Navigate to ‘e-Proceedings’ under the “Pending Actions” tab.

-

Click on the Section 142(1) notice.

-

Attach the required documents, explanations, and responses.

-

Submit your reply within the specified due date.

Failing to comply can lead to:

-

Best judgment assessment under Section 144

-

Penalties and interest

-

In extreme cases, prosecution

Difference Between Notices Under Sections 142(1) and 143(2)

| Basis | Section 142(1) | Section 143(2) |

|---|---|---|

| Purpose | To request return or details for assessment | For detailed scrutiny of filed ITR |

| Applicability | Filed or not filed return | Only when return is already filed |

| Action by AO | Can ask for accounts and documents | Seeks further verification or scrutiny |

| Timeline | Can be sent even before return is filed | Must be sent within 6 months of filing |

Legal Validity and Deadlines

-

The AO must allow reasonable time for submission of details (usually 15 to 30 days).

-

Section 142(1) is applicable even if the taxpayer is not liable to file returns, but is involved in high-value transactions.

Best Practices to Avoid Receiving a 142(1) Notice

-

File your ITR before the due date, even if your income is below the threshold but you’ve had large transactions (like buying property, high-value mutual funds, etc.).

-

Reconcile income details with Form 26AS, AIS, and TIS before filing.

-

Avoid claiming deductions or exemptions without supporting documents.

-

Keep proper books of accounts if you’re a business or professional.

Need Help Replying to a 142(1) Notice?

At Tradeviser, we assist taxpayers in handling income tax notices professionally—from drafting replies to representation before the department. Don’t risk a penalty due to a missed or mishandled notice.

Talk to our experts today and respond to your tax notice with confidence.

CA Madhusmita Padal is a Practicing Chartered Accountant with firms based in Odisha and Chennai. She specializes in taxation, company law, and auditing. She is passionate about simplifying complex concepts and making knowledge accessible to all.