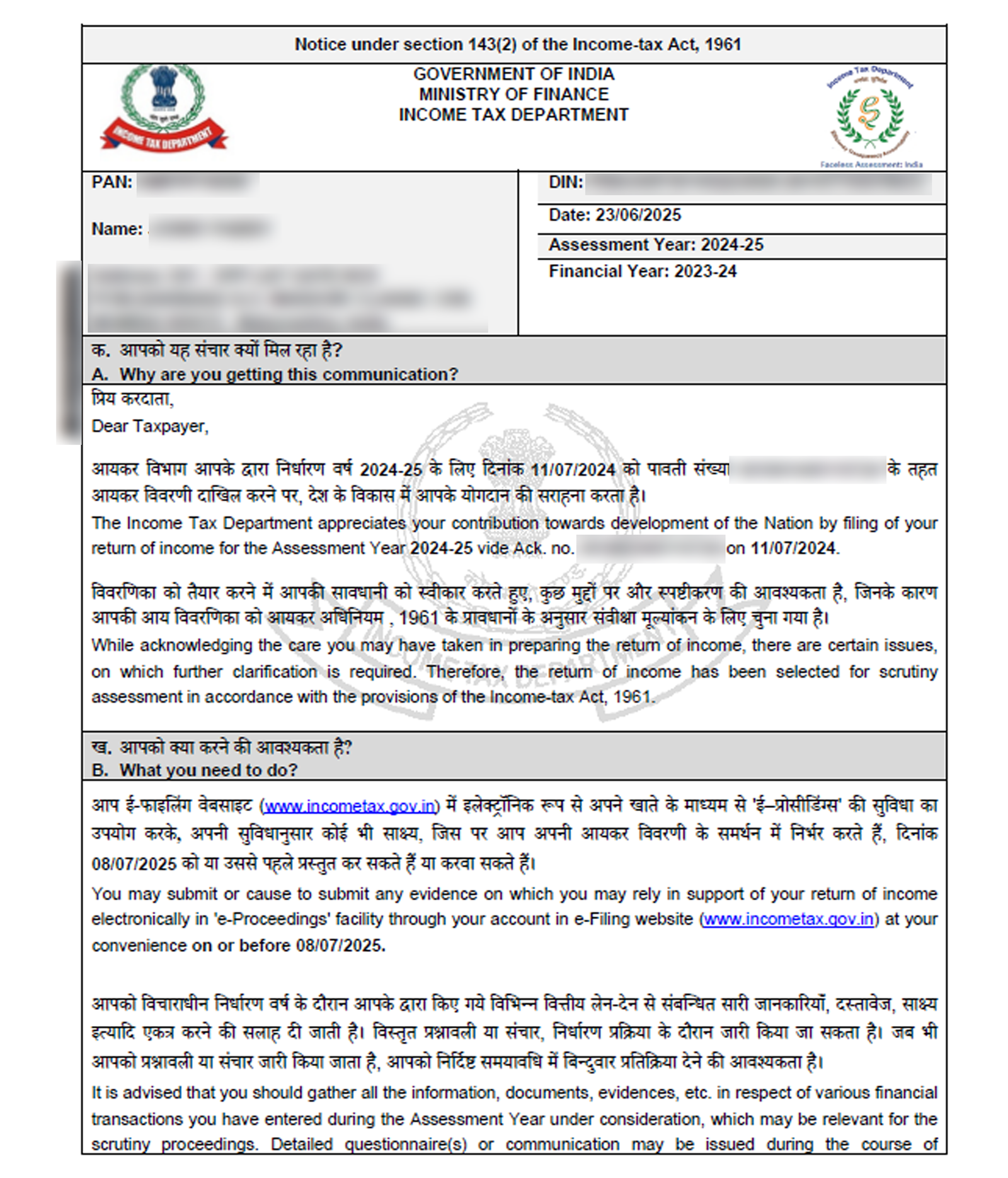

What is Section 143(2) of the Income Tax Act?

Section 143(2) is a statutory provision that empowers the Assessing Officer (AO) to scrutinize your income tax return (ITR) more closely. This section comes into play when the AO believes the ITR filed needs further verification.

It is issued only after you’ve filed your return, either under Section 139 or in response to a notice under Section 142(1).

Mass Notices Under Section 143(2): What You Should Know

Lately, the Income Tax Department has been actively sending mass scrutiny notices under Section 143(2) to both salaried individuals and businesses. These notices are part of the department’s effort to ensure that the returns filed are accurate and free from discrepancies. If you’ve received one, it’s essential to know this is a routine compliance measure not necessarily an allegation of wrongdoing.

Yet, how you respond matters. A timely and correct reply can save you from future complications.

Why Did I Get a Notice Under Section 143(2)?

You could receive this notice for several reasons, including:

-

A mismatch between reported income and actual bank or investment transactions.

-

High-value expenses (e.g., foreign travel, luxury purchases) not justified by declared income.

-

Inconsistencies in TDS, advance tax, or deductions claimed.

-

Random selection by Computer-Assisted Scrutiny Selection (CASS) for quality checks.

-

Transactions reported in AIS or 26AS not reflected in your ITR.

Receiving the notice doesn’t always mean you’re in trouble. It simply means your return is under review for accuracy and completeness.

Types of Scrutiny Notices Under Section 143(2)

1. Limited Scrutiny

Issued to verify specific aspects of your return, such as:

-

Cash deposits during demonetisation

-

Mismatch in TDS claims

-

High-value mutual fund or share transactions

2. Complete Scrutiny

Involves a detailed review of your entire return, including income, expenses, deductions, and assets. Often issued to businesses or high-net-worth individuals.

3. Manual Scrutiny

Selected based on flagged risk factors, where the AO manually reviews your ITR for anomalies.

Timeline and Validity of 143(2) Notice

-

The notice must be issued within 3 months from the end of the financial year in which the return is filed.

-

If not issued within this time, the scrutiny under Section 143(2) is time-barred.

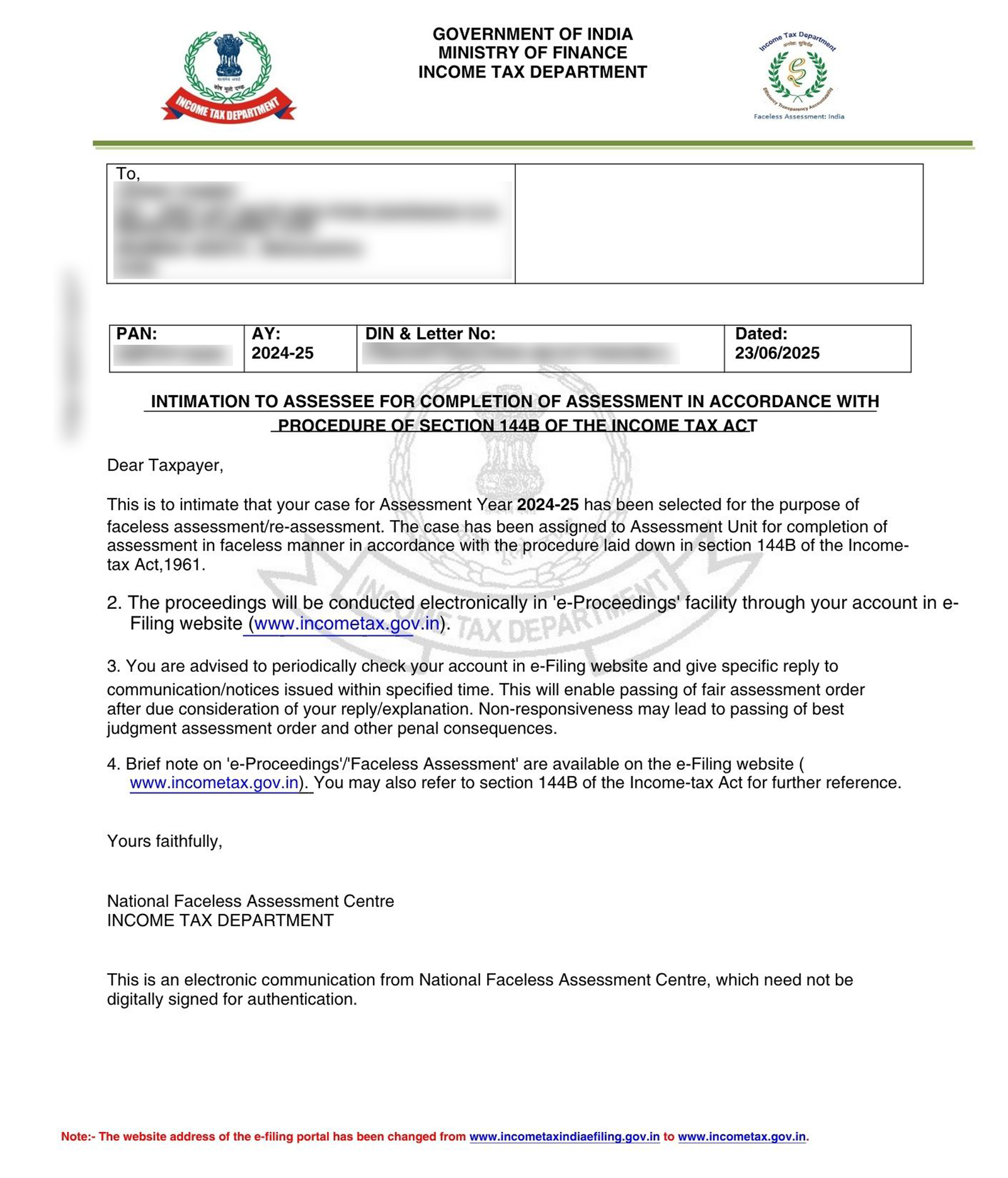

How to Respond to a Notice Under Section 143(2)

-

Log in to the Income Tax e-filing portal at incometax.gov.in.

-

Go to Pending Actions > e-Proceedings and download the notice.

-

Check the assessment year and reasons mentioned.

-

Prepare documentation supporting your ITR:

-

Form 16, salary slips, rent receipts

-

Investment proofs (ELSS, PPF, etc.)

-

Bank and trading statements

-

Books of accounts (for businesses)

-

-

Submit a detailed response online, along with scanned documents.

-

If required, attend the personal hearing scheduled by the AO.

-

Keep copies of all submissions and acknowledgement receipts.

Consequences of Not Responding

If you ignore or delay your response:

-

The AO can pass an ex parte order based on limited information.

-

You may face additional tax demand, penalty, or interest under Section 271(1)(c).

-

Your case may get escalated for reassessment or prosecution in severe cases.

Can a 143(2) Notice Be Challenged?

Yes, but only under specific conditions. For example:

-

If the notice is issued after the time limit, you can challenge it.

-

If the jurisdiction of the AO is incorrect, you can object under Section 124.

Consult a professional before contesting a notice, as these are technical areas.

How is it Different from Section 143(1)?

| Feature | Section 143(1) | Section 143(2) |

|---|---|---|

| Purpose | Intimation of basic return processing | Scrutiny for verification |

| Issued For | All returns | Selected returns only |

| Action Required | Usually none | Mandatory response |

| Risk Level | Low | Moderate to High |

How to Avoid Receiving Future Scrutiny Notices

-

File your ITR correctly and on time.

-

Match your TDS with Form 26AS and AIS.

-

Report all sources of income, including foreign income.

-

Ensure capital gains, dividends, and interest income are declared.

-

Avoid large cash transactions that aren’t justified.

Need Help With 143(2) Notice Response?

At Tradeviser, we specialize in handling Income Tax scrutiny cases under Section 143(2). From drafting a professional response to representing you before the Assessing Officer, we manage it all accurately and on time.

Contact us today to avoid tax stress and ensure 100% compliance.

CA Madhusmita Padal is a Practicing Chartered Accountant with firms based in Odisha and Chennai. She specializes in taxation, company law, and auditing. She is passionate about simplifying complex concepts and making knowledge accessible to all.