Section 144B of Income Tax Act: Understanding the Faceless Assessment Scheme

In an effort to improve transparency and reduce direct contact between taxpayers and tax authorities, the Income Tax Department introduced Section 144B of the Income Tax Act. This section forms the backbone of the Faceless Assessment Scheme, which aims to simplify and digitize the assessment process.

If you’ve received a notice or communication under Section 144B, or simply want to understand how it affects your tax filings, this article will walk you through everything you need to know.

What Is Section 144B of the Income Tax Act?

Section 144B, introduced by the Finance Act, 2020 and amended thereafter, lays down the legal framework for faceless income tax assessments. It empowers the Central Board of Direct Taxes (CBDT) to establish centres for faceless proceedings, including assessments, appeals, penalties, and more.

The goal is to:

-

Eliminate physical interface

-

Enhance efficiency and accountability

-

Ensure fairness in tax administration

All communication is carried out electronically through the income tax portal, and allocation of cases is done using automated systems to maintain anonymity and objectivity.

How Does the Faceless Assessment Process Work Under Section 144B?

Here is a step-by-step breakdown of the faceless assessment procedure under Section 144B:

1. Case Assignment

An assessment case is allocated to a National Faceless Assessment Centre (NaFAC) through a system-generated process.

2. Notices Issued

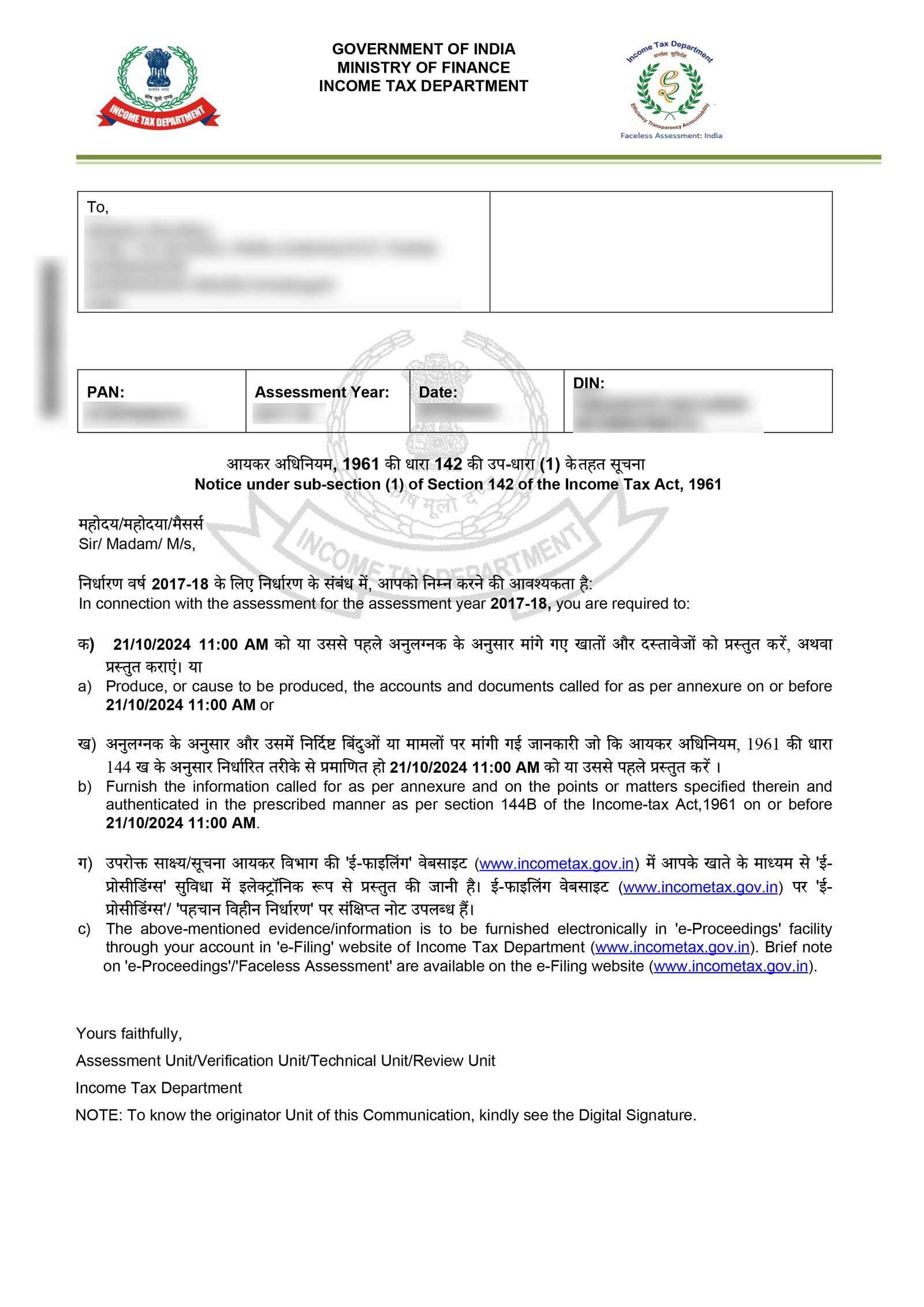

NaFAC may issue notices under Section 143(2), 142(1), or 144, seeking information or clarification. All responses must be submitted online through the income tax portal.

3. Draft Order Preparation

Once the assessing unit reviews submissions, it may:

-

Accept the return as it is, or

-

Propose adjustments

A draft assessment order is prepared and sent for review to a Review Unit, if required.

4. Final Order Issuance

Based on feedback from the review unit or without it (in simple cases), the NaFAC issues the final assessment order electronically.

5. Penalty or Demand Notice (if any)

The final order may be accompanied by a demand notice, penalty, or refund order.

All proceedings, including appeals and rectifications, are also handled through electronic communication only.

Key Features of Section 144B and Faceless Assessment

-

No physical interface: Taxpayer and officer do not meet face-to-face.

-

Automated case allocation: Selection and assignment are done digitally to avoid bias.

-

Layered review mechanism: Draft orders go through a separate review unit to ensure accuracy.

-

Real-time tracking: Taxpayers can track notices and responses through their login.

-

No room for discretion: Reduced chances of harassment or arbitrary additions.

Benefits of Faceless Assessment

-

Transparency: Since everything is documented electronically, there’s a clear trail.

-

Efficiency: Streamlined communication and automated processing reduce delays.

-

Accountability: Layered review and system-driven allocation improve quality control.

-

Taxpayer Convenience: You can respond to notices from anywhere, without visiting the tax office.

Important Points for Taxpayers to Keep in Mind

-

Always check your email and income tax portal regularly for notices.

-

Maintain accurate documentation of your income, deductions, and transactions.

-

Respond to queries and notices within deadlines to avoid penalty or adverse orders.

-

Save PDF copies of submissions and orders for future reference.

-

If required, take professional help to draft replies, especially in complex cases.

Section 144B vs. Traditional Assessment

| Feature | Traditional Assessment | Faceless Assessment (Section 144B) |

|---|---|---|

| Physical interaction | Yes | No |

| Assessment location | Jurisdiction-based officer | Centrally allocated by CBDT |

| Scope for discretion | Higher | Minimal |

| Transparency | Limited | High |

| Mode of communication | Physical & email | Fully digital |

Final Thoughts

Section 144B marks a major step in India’s tax reform journey. With faceless assessment, the government aims to build a tax system that is more taxpayer-friendly, efficient, and trustworthy.

However, since the process is entirely online, being aware of deadlines and proper filing practices becomes more important than ever.

Need Help Responding to a Faceless Assessment Notice?

Tradeviser offers expert guidance on replying to notices, handling faceless assessments, and ensuring 100% compliance with Section 144B. Avoid mistakes that could lead to penalties—get in touch with our tax experts today.

CA Madhusmita Padal is a Practicing Chartered Accountant with firms based in Odisha and Chennai. She specializes in taxation, company law, and auditing. She is passionate about simplifying complex concepts and making knowledge accessible to all.