Understanding Section 143(1) Income Tax Intimation

When you file your Income Tax Return (ITR), the Income Tax Department processes it to verify correctness. A communication under Section 143(1) does not imply you are under scrutiny or audit—it is merely an intimation that confirms that the department has processed your return and either accepted it or highlighted simple mathematical corrections.

Here’s a detailed and reader-friendly analysis of Section 143(1) intimation, broken down with clarity and professional insights for taxpayers.

What Is Section 143(1) Intimation?

Under Section 143(1) of the Income Tax Act, the Income Tax Department sends an intimation after processing your filed ITR. It may involve:

-

Acceptance of return without changes

-

Adjustments due to arithmetic errors, incorrect claims, or calculation mistakes

-

Imposition of interest under Section 234A, 234B, or 234C

You must review this intimation, especially if a refund has reduced, a demand is created, or interest is charged.

How Section 143(1) Works in the Processing Cycle

-

You file your ITR and upload Form 26AS details.

-

The system compares self-declared income and taxes with available financial information.

-

If there are simple arithmetic discrepancies, the system auto-adjusts.

-

An intimation (ITR-V) is sent electronically detailing any changes.

-

This typically happens within 10–45 days after filing, via the e-filing portal.

What Section 143(1) Intimation May Include

-

Corrected income or deductions

-

Tax payable or payable adjustment

-

Interest for late filing or late payment

-

Revised refund amount

-

Penalty (rare, mostly if delay or misreporting is detected)

Why You Received an Intimation

Chances are there is no issue whatso even and this communication is just the department informing you about the processing of the ITR, but sometimes there might be issues with your ITR, in such cases, the notice could include proposed adjustment(s) u/s. 143(1)(a).

Common reasons include:

-

Wrong computation or omission of income

-

Mismatch in Form 26AS TDS records and claim

-

Interest or dividend income not reported

-

HRA, LTA, or 80C claims incremental beyond limits

-

Missing advance tax entries

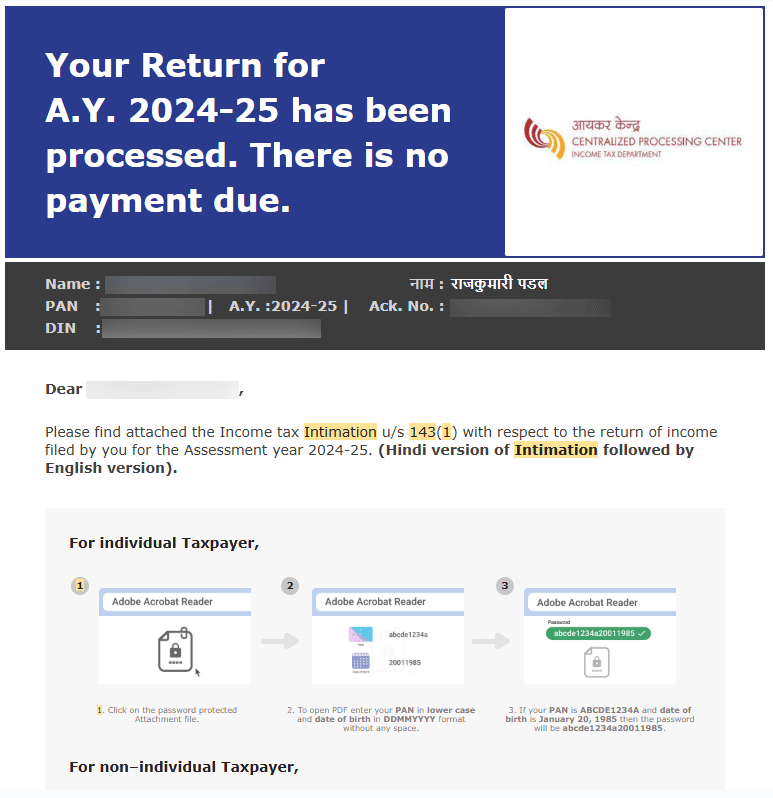

Steps to Review Your Intimation

-

Log in to the income tax e-filing portal

-

Navigate to “View Intimations” under e-file

-

Download and open the intimation PDF

-

Compare the Department’s calculations with your submitted return

-

Note changes in tax payable/refunded

If the Intimation Shows No Change (Accept)

If the return is processed without any change, simply retain the intimation. It confirms that your filing is accepted and no further action is required unless you disagree with future notices.

If the Intimation Includes a Demand or Deposits

When the intimation informs you of extra tax, follow these steps:

-

Verify: Ensure the demand is genuine and calculations are correct

-

Pay: Use “e-pay tax” option on the portal

-

File Response: Submit a response or revised return if errors are significant or genuine

-

Dispute: File an online rectification request under Section 154 within 30 days from date of intimation

Refund Adjustments and Delays

If the refund amount has changed or been set off:

-

Allow 2 to 4 weeks for processing

-

Track refund status through the ITR portal or your bank account

-

Contact CPC Bengaluru if the refund is delayed beyond 30 days

Interest Charged Under Sections 234A/B/C

Automatic processing may levy such interest if:

-

ITR filed after due date (234A)

-

Advance tax is less than 90% (234B/234C)

-

Part tax is paid late

If you disagree with the interest, file a rectification request explaining the situation and providing evidence.

Rectification Process Under Section 154

You can request correction for:

-

Arithmetic or clerical errors

-

Wrongly accepted TDS or deduction

-

Misapplication of Income Tax Act

To act, go to “e-file → Rectification” on the portal and provide details within 30 days.

Disputes Beyond Section 154

For more complex disagreements or disallowed claims, you may need to approach:

-

The Assessing Officer via filing revised ITR (if allowed)

-

The Income Tax Appellate Authority (ITAT)

-

File a Sadakaju appeal

Preventing Misleading 143(1) Demands

-

Recheck Form 26AS and AIS before filing

-

File ITRs accurately and on time

-

Pay advance tax when liability is above ₹10,000

-

Reconcile claims involving TDS, HRA, deductions, etc.

Timing and Validity

You have 30 days from the date of intimation to respond or file rectification. It is critical to act promptly to avoid forfeiture of your rights or interests.

Real-World Examples

Example 1: Notice of extra Rs 5,000 due to unreported FD interest; 234B interest applied.

Resolution involves adding FD interest to ITR and paying both taxes plus interest.

Example 2: TDS claimed in return but not up to date in Form 26AS.

You upload missing TDS forms or request your employer to re-file TDS statement; file rectification.

Final Thoughts on 143(1) Intimation

Your intimation is a checkpoint—not a notice of investigation. Most discrepancies are minor. Timely review, accurate ITR filing, and prompt response can address demands effectively.

FAQs on Section 143(1) Intimation

-

What does it mean when I receive a Section 143(1) intimation?

The department has processed your ITR and made adjustments for arithmetic mismatches. You must verify and act if necessary. -

Does 143(1) intimation mean I am under scrutiny?

No. It is an automated processing step, not an audit or detailed examination. -

What is the timeline to respond to a demand in intimation?

You have 30 days from the date of intimation to respond or file for correction. -

Can I pay increased tax online post intimations?

Yes, you can use the “e-pay tax” option on the e-filing portal. -

How do I challenge an incorrect intimation?

File a rectification request under Section 154 with supporting documents. -

Will interest be charged if I ignore the demand?

Yes. If not paid within 30 days or disputed properly, additional interest and penalty may apply. -

What if my refund amount is reduced in the intimation?

That means your liability has increased or a higher TDS was claimed. Track the new refund via portal. -

Does filing a rectification delay refund?

It may. Until rectification is processed, refund timeline may be extended. -

Do I need a Chartered Accountant to respond to 143(1) intimation?

Not always. For straightforward calculations, you can respond yourself. Professional help is better for complex cases. -

Can I ignore 143(1) intimation if no changes are mentioned?

Yes. If no change was made and refund status confirms, no further action is needed.

Need Help Replying to an Income Tax Notice?

At Tradeviser, we assist taxpayers in handling income tax notices professionally—from drafting replies to representation before the department. Don’t risk a penalty due to a missed or mishandled notice.

Talk to our experts today and respond to your tax notice with confidence.

CA Madhusmita Padal is a Practicing Chartered Accountant with firms based in Odisha and Chennai. She specializes in taxation, company law, and auditing. She is passionate about simplifying complex concepts and making knowledge accessible to all.