E-Verification of Income Tax Return: A Complete Guide for Taxpayers

Filing your Income Tax Return (ITR) is only half the job done. The other equally important step is e verification of income tax return. Without verifying your return, it will be treated as invalid, and you may face penalties or legal complications.

This guide explains everything about e-verification, its importance, methods available, and how to avoid common mistakes that taxpayers often make.

What Is E-Verification of Income Tax Return?

E-verification is the process of electronically confirming the authenticity of your ITR filed on the Income Tax portal. It acts as a digital signature or acknowledgment that the information furnished is complete and accurate to your knowledge.

As per Rule 12 of the Income Tax Rules, e-verification must be completed within 30 days of filing the return.

Why Is E-Verification Important?

If you file your ITR but do not verify it:

- Your return is not processed by the Income Tax Department

- The return is considered invalid, meaning it is as good as not filed

- You may lose the benefits of timely filing, such as:

- Avoiding late fees

- Interest on refund

- Carry forward of losses

Hence, verification is mandatory to complete the ITR filing process.

E-Verification vs Physical Verification (ITR-V)

Earlier, taxpayers had the option to send a physical signed copy of ITR-V to the Centralised Processing Centre (CPC) in Bengaluru. Now, e-verification is the preferred and quicker method.

While the physical method is still available, it is less efficient, takes longer, and risks postal delays. Most taxpayers now use online e-verification for convenience and speed.

Methods Available for E-Verification

You can complete the e-verification of income tax return using any of the following options:

- Aadhaar OTP

- Link your PAN with Aadhaar

- Enable Aadhaar-based OTP verification

- OTP sent to your registered mobile number

- Most popular and hassle-free method

- Net Banking

- Log in to your bank’s net banking account

- Navigate to Income Tax Filing section

- Redirected to the e-Filing portal for verification

- Bank Account EVC (Electronic Verification Code)

- Pre-validate your bank account on the Income Tax portal

- Receive EVC on your registered mobile and email

- Enter EVC to complete the verification

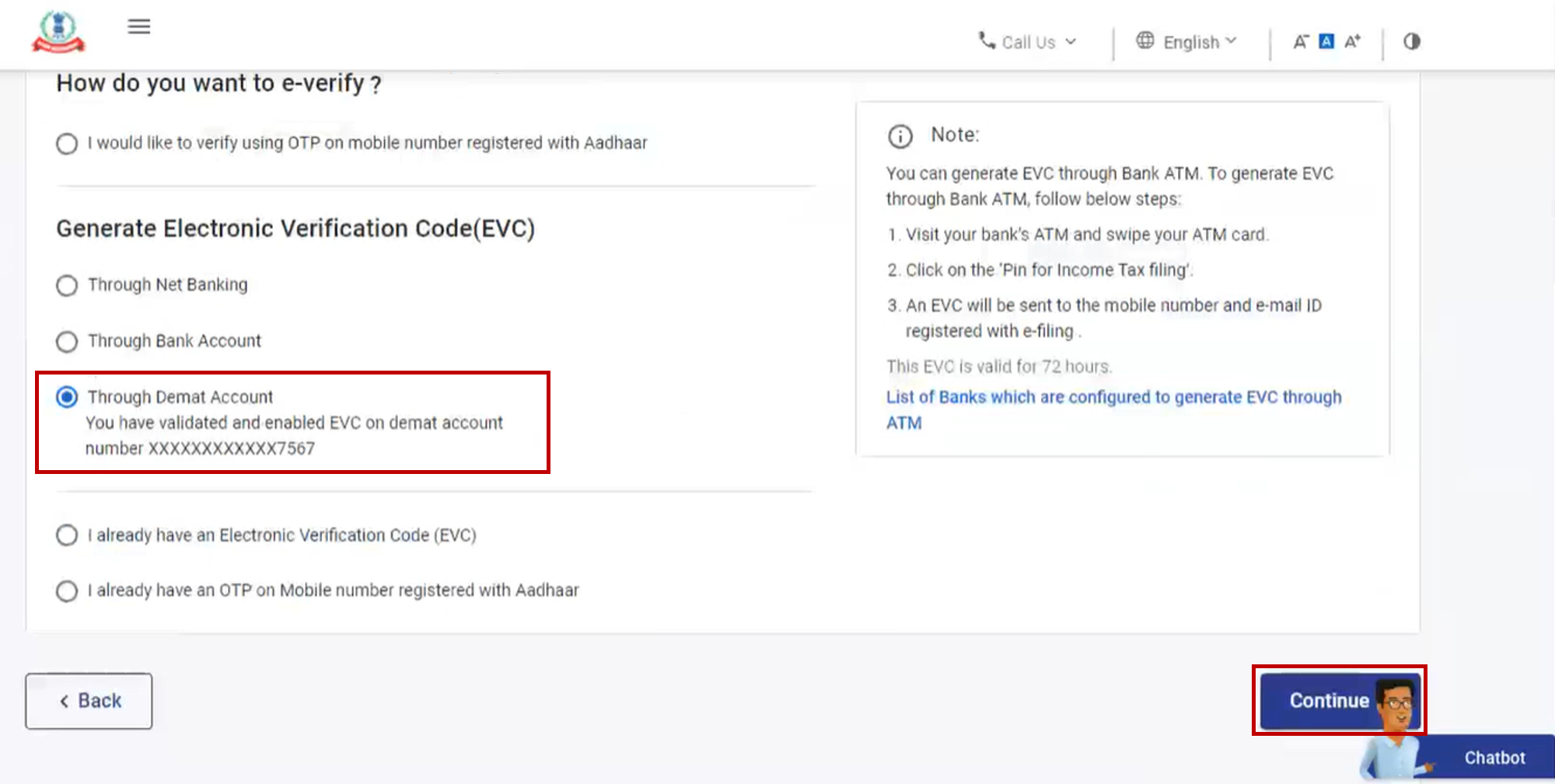

- Demat Account EVC

- Similar to Bank EVC

- Requires pre-validation of your Demat account

- Digital Signature Certificate (DSC)

- Mandatory for companies and audit cases

- Requires a valid Class 2 or 3 DSC token

- Must be registered with the Income Tax portal

Each method is secure and designed to prevent fraud or unauthorized access.

Step-by-Step: How to E-Verify Your ITR

Here’s a quick guide using the Aadhaar OTP method:

- Log in to https://www.incometax.gov.in

- Go to e-File > Income Tax Returns > e-Verify Return

- Select the return you want to verify

- Choose “Verify using OTP on mobile number registered with Aadhaar”

- Enter the 6-digit OTP sent to your Aadhaar-linked mobile number

- Submit and receive the confirmation message

Repeat similar steps for other methods like net banking or bank EVC.

What Is the Time Limit for E-Verification?

The current time limit is 30 days from the date of ITR filing. For example, if you filed your return on 15th July, you must verify it by 14th August.

If not verified within this period:

- The return becomes invalid

- You will have to file a belated return, possibly with penalties

Always keep a record of the Acknowledgement Number after successful e-verification.

Common Mistakes to Avoid During E-Verification

- Not linking Aadhaar with PAN

- Using unregistered mobile numbers or emails

- Forgetting to pre-validate bank or Demat accounts

- Waiting till the last day and facing OTP or server issues

- Confusing the filing date with verification date

Avoid these to ensure your return is successfully accepted by the department.

FAQs: E Verification of Income Tax Return

- Is e-verification compulsory after filing ITR?

Yes, your return is not considered filed unless verified within 30 days. - What happens if I don’t verify my return?

Your ITR is treated as invalid, and you may face penalties or lose tax benefits. - Can I verify my return without Aadhaar?

Yes, you can use net banking, EVC, or DSC as alternatives. - How do I know if my return is successfully verified?

You will receive a confirmation email and SMS from the Income Tax Department with an acknowledgment number. - Can I re-verify my return?

No, once verified, re-verification is not needed unless the original return is revised or rectified. - Is there a fee for e-verification?

No, e-verification is free of cost through all official channels. - Can someone else verify my return on my behalf?

Only if you are using a DSC and authorized representative. Otherwise, e-verification must be done by the taxpayer. - Can I e-verify revised returns too?

Yes, each revised return must be individually e-verified. - Are business owners required to e-verify?

Yes, and companies must use DSC for verification. - Is it safe to e-verify using net banking?

Yes, net banking is secure and officially integrated with the Income Tax portal

CA Madhusmita Padal is a Practicing Chartered Accountant with firms based in Odisha and Chennai. She specializes in taxation, company law, and auditing. She is passionate about simplifying complex concepts and making knowledge accessible to all.