TDS Search

Search Rates | Section No | Slab

eg, Type in Salary or Section 192 to find out rates

Rates for AY 2018-19

Click here to search TCS rates

Every Business making payments as specified by the act like salary payment, interest on securities, contract payment, dividends etc is liable to deduct tax at source at specified rates and deposit the same with the government every month and file returns for such every quarter. Along with Companies & LLPs even Individuals & HUFs are liable to deduct tax at source for such specified payments if they are liable to Tax Audit.

A person liable for deduction has to apply for Tax Deduction & Collection Account Number (TAN) to enable him to deduct & file returns.

TDS vs TCS

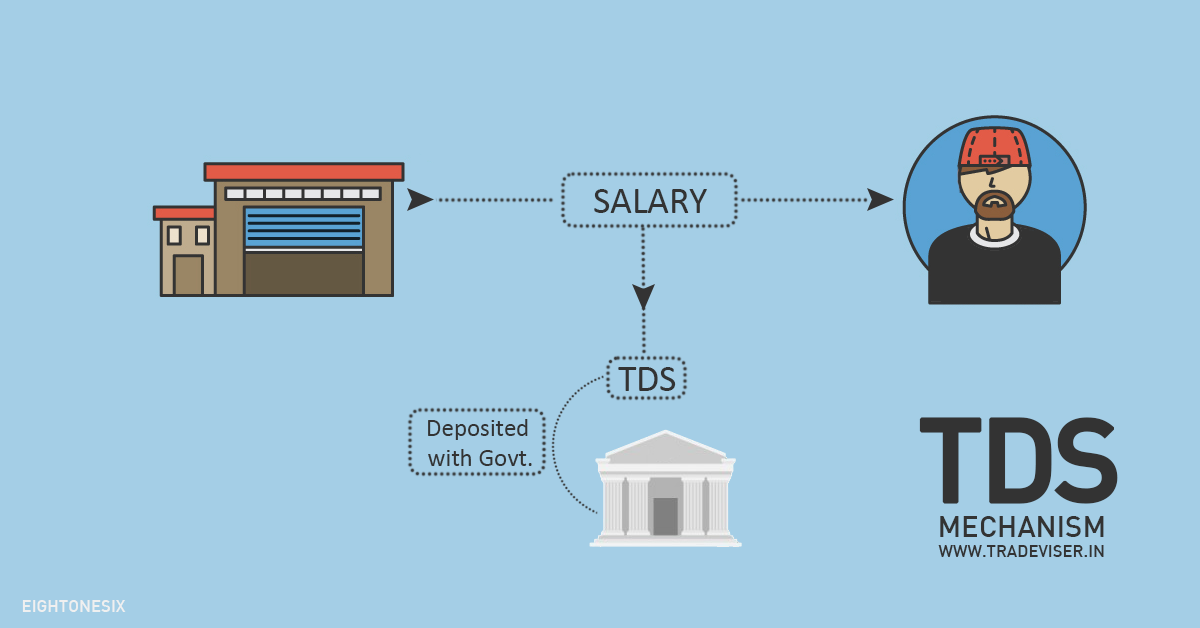

TDS

TDS or Tax Deducted at Source is a mechanism where the payer deducts a certain portion of the payment as tax of the receiver and deposits the same with the government. For example:A provides technical services to B for 50,000 INR,

B is liable to deduct TDS @ 10%, i.e 5,000 INR and A receives 45,000 INR

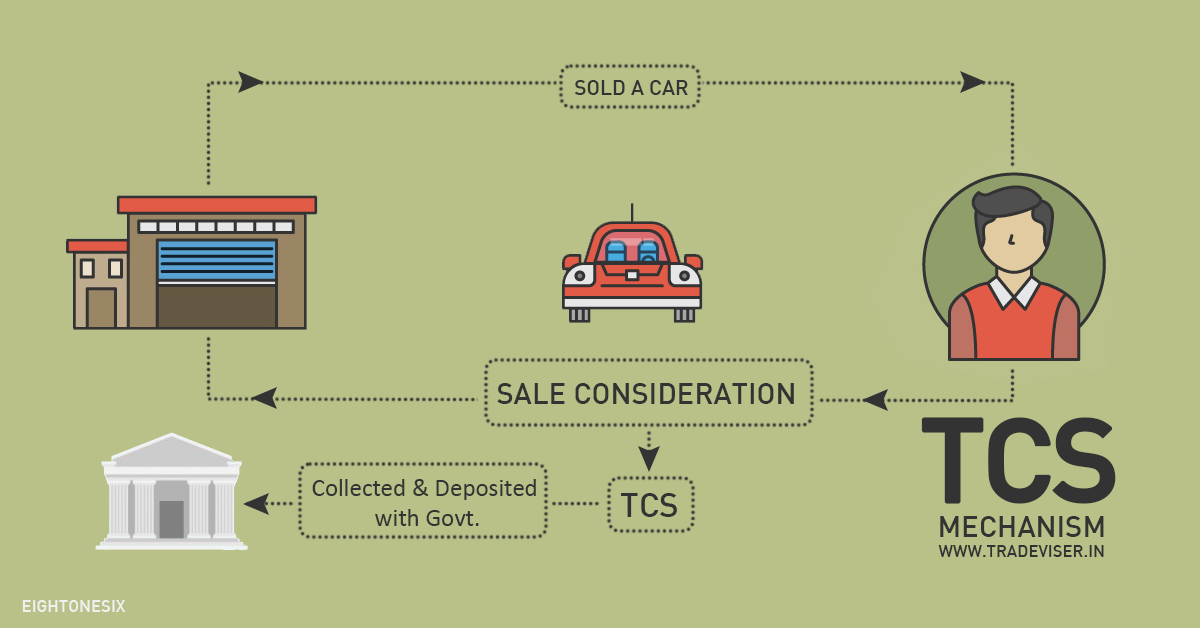

TCS

TCS or Tax Collected at Source is a mechanism where the receiver extracts a certain amount as tax of the payer and deposits the same with the governmentFor exampleA is selling a Motor Car worth 12 Lakhs,

A is liable to collect TCS @ 1% on the sale consideration and deposit the same with Govt.B pays 12.12 Lakhs (12 Lakhs + 1%)