Empowering Entrepreneurs: Your Comprehensive Guide to Stand-Up India Scheme

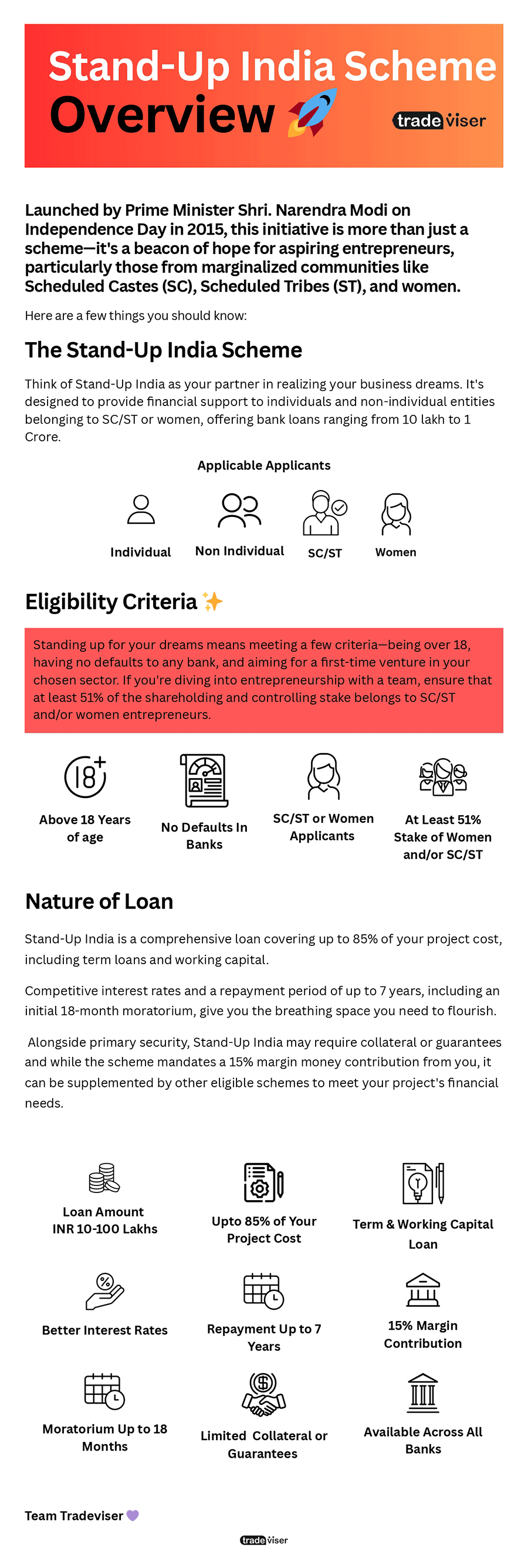

Imagine a world where your entrepreneurial dreams aren’t just aspirations but achievable goals. That’s precisely what Stand-Up India aims to offer. Launched by Prime Minister Shri. Narendra Modi on Independence Day in 2015, this initiative is more than just a scheme—it’s a beacon of hope for aspiring entrepreneurs, particularly those from marginalized communities like Scheduled Castes (SC), Scheduled Tribes (ST), and women.

Understanding Stand-Up India: Think of Stand-Up India as your partner in realizing your business dreams. It’s designed to provide financial support to individuals and non-individual entities belonging to SC/ST or women, offering bank loans ranging from 10 lakh to 1 Crore. Whether you’re venturing into manufacturing, services, agri-allied activities, or trading, Stand-Up India has got your back.

Eligibility Criteria: Standing up for your dreams means meeting a few criteria—being over 18, having no defaults to any bank, and aiming for a first-time venture in your chosen sector. If you’re diving into entrepreneurship with a team, ensure that at least 51% of the shareholding and controlling stake belongs to SC/ST and/or women entrepreneurs.

Nature of Loan: Picture this: a comprehensive loan covering up to 85% of your project cost, including term loans and working capital. With Stand-Up India, your financial worries are minimized, allowing you to focus on building and growing your business.

Interest Rate and Repayment: The financial aspect of entrepreneurship can be daunting, but with Stand-Up India, it’s manageable. Competitive interest rates and a repayment period of up to 7 years, including an initial 18-month moratorium, give you the breathing space you need to flourish.

Security and Margin Money: Every journey needs some security, and your entrepreneurial journey is no different. Alongside primary security, Stand-Up India may require collateral or guarantees and while the scheme mandates a 15% margin money contribution from you, it can be supplemented by other eligible schemes to meet your project’s financial needs.

Operational Details: This Scheme operates across all branches of scheduled commercial banks in India, ensuring accessibility for every dreamer. From financial support to guidance, this initiative is your partner in entrepreneurial success, no matter where you are in the country.

Conclusion: With Stand-Up India, your entrepreneurial journey transforms from a distant dream into a tangible reality. It’s more than just a scheme; it’s an opportunity for economic empowerment, job creation, and societal development. So, let’s stand up together and embark on the journey of entrepreneurial excellence!

Tradeviser, an idea shaped into reality with the motive of helping new businesses and startups with professional guidance end-to-end business services. Ever since its inception since 2016, Team Tradeviser has worked diligently with over 200 startups and been part of their of their sedulous journey to make it to the big picture.