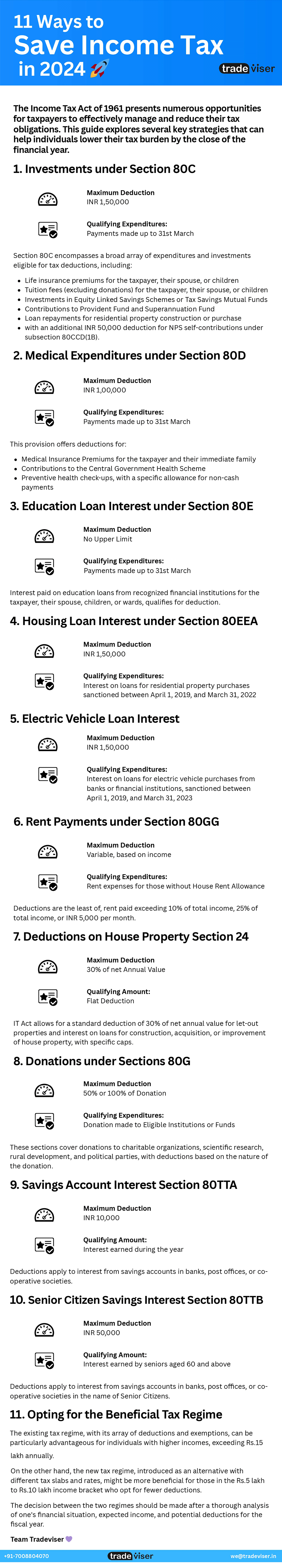

11 Ways to Save Income Tax in 2024: A Comprehensive Guide

The Income Tax Act of 1961 presents numerous opportunities for taxpayers to effectively manage and reduce their tax obligations. This guide explores several key strategies that can help individuals lower their tax burden by the close of the financial year.

1. Investments and Payments under Section 80C, 80CCC, and 80CCD

- Maximum Deduction Cap: INR 1,50,000 (Additional 50,000 under 80CCD(1B))

- Qualifying Expenditures: Payments made up to 31st March

Section 80C encompasses a broad array of expenditures and investments eligible for tax deductions, including:

- Life insurance premiums for the taxpayer, their spouse, or children

- Tuition fees (excluding donations) for the taxpayer, their spouse, or children

- Investments in Equity Linked Savings Schemes or Tax Savings Mutual Funds

- Contributions to Provident Fund and Superannuation Fund

- Loan repayments for residential property construction or purchase

- Additional INR 50,000 Deduction for NPS

Section 80CCC permits deductions for certain pension fund contributions, while Section 80CCD allows for deductions related to contributions towards the Employee Pension Scheme (EPS) or National Pension Scheme (NPS), with an additional INR 50,000 deduction for NPS self-contributions under subsection 80CCD(1B).

2. Medical Expenditures under Section 80D

- Maximum Deduction: INR 1,00,000

- Qualifying Expenditures: Payments made up to 31st March

This provision offers deductions for:

- Medical Insurance Premiums for the taxpayer and their immediate family

- Contributions to the Central Government Health Scheme

- Preventive health check-ups, with a specific allowance for non-cash payments

The deduction thresholds are categorized as follows:

Up to ₹25,000 for premiums paid on behalf of oneself, spouse, dependent children, or parents.

A higher limit of ₹50,000 is available for those instances where the insured, including family members or parents, are classified as senior citizens (aged 60 years and over).

3. Education Loan Interest under Section 80E

- Maximum Deduction: Unlimited

- Qualifying Expenditures: Previous year expenses

Interest paid on education loans from recognized financial institutions for the taxpayer, their spouse, children, or wards, qualifies for deduction.

4. Housing Loan Interest (New Homes) under Section 80EEA

- Maximum Deduction: INR 1,50,000

- Eligibility: Interest on loans for residential property purchases sanctioned between April 1, 2019, and March 31, 2022

5. Electric Vehicle Loan Interest under Section 80EEB

- Maximum Deduction: INR 1,50,000

- Eligibility: Interest on loans for electric vehicle purchases from banks or financial institutions, sanctioned between April 1, 2019, and March 31, 2023

6. Rent Payments under Section 80GG

- Maximum Deduction: Variable, based on income

- Eligibility: Rent expenses for those without House Rent Allowance

Deductions are the lesser of rent paid exceeding 10% of total income, 25% of total income, or INR 5,000 per month.

7. Deductions on House Property under Section 24

Allows for a standard deduction of 30% of net annual value for let-out properties and interest on loans for construction, acquisition, or improvement of house property, with specific caps.

8. Donations under Sections 80G, 80GGA, and 80GGC

- Maximum Deduction: 50% or 100% of Donation

- Eligibility: Donation made to Eligible Institutions or Funds

These sections cover donations to charitable organizations, scientific research, rural development, and political parties, with deductions based on the nature of the donation.

9. Savings Account Interest under Section 80TTA

- Maximum Deduction: INR 10,000

- Eligibility: Interest earned during the year

Deductions apply to interest from savings accounts in banks, post offices, or co-operative societies.

10. Senior Citizen Savings Interest under Section 80TTB

- Maximum Deduction: INR 50,000

- Eligibility: Interest earned by seniors aged 60 and above

Deductions apply to interest from savings accounts in banks, post offices, or co-operative societies for senior citizens.

11. Opting for the Most Beneficial Tax Regime

When navigating the complexities of income tax planning for the year 2024, one of the strategic decisions involves choosing between the existing tax regime and the new optional regime. This choice can significantly impact the amount of tax you are liable to pay, based on your income level and the deductions you plan to claim.

The existing tax regime, with its array of deductions and exemptions, can be particularly advantageous for individuals with higher incomes, exceeding Rs.15 lakh annually. These taxpayers can leverage tax-saving investments, such as contributions to the National Pension System (NPS), life insurance premiums, and health insurance, to reduce their taxable income substantially.

On the other hand, the new tax regime, introduced as an alternative with different tax slabs and rates, might be more beneficial for those in the Rs.5 lakh to Rs.10 lakh income bracket who opt for fewer deductions. The new regime offers lower tax rates but requires foregoing most deductions and exemptions available under the existing system. For individuals who either do not have significant investments in tax-saving instruments or prefer a simpler tax calculation without the need to track and claim various deductions, the new regime could result in lower overall tax liability.

The decision between the two regimes should be made after a thorough analysis of one’s financial situation, expected income, and potential deductions for the fiscal year and comparing of tax computed under both regimes. For many, this decision could mean the difference between significant savings and unnecessary tax payments. It is also advisable to consult with a tax professional to make an informed choice that aligns with your financial goals and tax-saving strategy for 2024.

Conclusion

This guide highlights essential avenues for tax savings under the Income Tax Act of 1961. For personalized advice, consulting a tax professional is recommended to maximize deductions based on individual financial situations.

Tradeviser, an idea shaped into reality with the motive of helping new businesses and startups with professional guidance end-to-end business services. Ever since its inception since 2016, Team Tradeviser has worked diligently with over 200 startups and been part of their of their sedulous journey to make it to the big picture.