Step-by-Step Guide to Securities Dematerialisation in 2023

It has been notified under the Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023 that every private company except Small Companies and Government Companies must issue their securities only in dematerialised form within 18 months from the closure of FY i.e 31st March 2023 in accordance with the provisions of Depositories Act.

It was mandatory for Listed and Unlisted companies to have their shares and securities in Dematerialised form for smooth Business of Trading. And Recently this requirement of Dematerialisation has also been extended to Private Companies under the Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023.

Securities mean ‘All kinds of securities i.e Equity Shares, Preference Shares, Debentures, Warrants. Etc’.

Let us understand what is Dematerialisation.

- The Process of converting physical shares and securities into electronic form.

- The Main intention is to simplify and smoothen the business of trading, buying, and selling the shares and securities.

- The benefit of Dematerialisation is cost-effective and user-friendly.

- All the securities will be stored in electronic form instead of a share certificate which is in physical form.

Advantages Of Dematerialisation

- Easy and instant Transfer electronically from one Company to another.

- No stamp duty or Risk of bad delivery attached.

- Minimum Paperwork with no Transaction or legal cost.

- A single Demat account of an individual can have multiple securities.

- No restriction or limit to transfer shares even one share can be transferred.

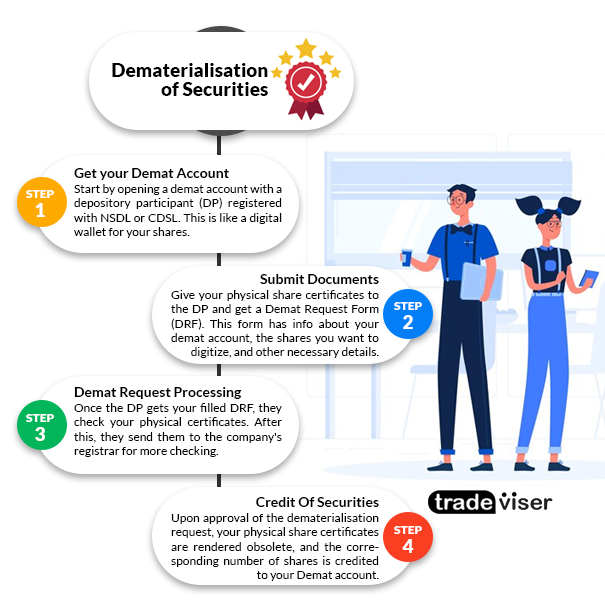

Process of Dematerialisation

- You have to choose one Depository to hold your securities in an electronic form among two Registered Securities in India i.e and Central Depository Services (India) Limited (CDSL) and National Securities Depository Limited (NSDL).

- And you cannot be directly involved with the Depository but have to interact through a Depository Participant who acts as an intermediary between you and the Depository.

- Public Financial Institutions, Stockbrokers, Commercial Banks, and NBFCs compliant with SEBI can be registered as Depository Participants to carry out the process of dematerialisation.

- For Converting the securities of a company from physical to Electronic Form both the company and the investor have to enter into an agreement with the Depository Participant with terms and conditions regarding buying and selling in Demat from.

- Depository participant carry out the transaction on behalf of their investors for buying and selling securities in electronic form.

- SEBI keeps and Eye on the Functioning of Depositories and their compliance with the Regulations.

Non-Compliance Consequences

No such Specific Penalty is specified, so Section 450 of the Act shall apply, where every company and every officer who is in default will be liable to pay Rs.10,000.

In case of continuous default penalty of Rs.1,000 for each day after the first during the contravention continues up to a maximum of Rs. 2,50,000 in the case of a company and Rs.50,000 in case of officer in default.

Essential Insights into Dematerialising Your Securities

In conclusion, navigating the intricacies of dematerialising securities in compliance with the new regulations can be a challenging task for companies. However, with the expertise and guidance of our professionals at Tradeviser, your journey towards dematerialisation can be seamless and efficient. Our experts are well-versed in the rules and regulations surrounding the compulsory dematerialisation of securities within the stipulated timeframe. By choosing Tradeviser, you gain a valuable partner dedicated to ensuring a smooth transition from physical to electronic form, allowing you to focus on your core business activities with confidence. Let our team of experts guide you through the process, making the transformation to dematerialised securities a hassle-free and cost-effective experience for your company.